Page 47 - Withholding Taxes for Foreign Entities

P. 47

10:50 - 14-Feb-2020

Page 45 of 55

Fileid: … tions/P515/2020/A/XML/Cycle10/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

A partnership may rely on a partner's certifi- Chart D. Documentation for To certify the deductions and losses, a part-

cation of nonforeign status and assume that a Foreign Partners* ner must submit to the partnership Form

partner is not a foreign partner unless the form: 8804-C.

• Does not give the partner's name, U.S. THEN provide to If the partner's investment in the partnership

TIN, and address; or the partnership is the only activity producing effectively connec-

• Is not signed under penalties of perjury IF you are a... Form... ted income and the section 1446 tax is less

and dated. nonresident alien W-8BEN. than $1,000, no withholding is required. The

The partnership must keep the certification partner must provide Form 8804-C to the part-

for as long as it may be relevant to the partner- foreign corporation W-8BEN-E. nership to receive the exemption from withhold-

ship's liability for section 1446 tax. foreign partnership W-8IMY. ing.

The partnership may not rely on the certifi- A foreign partner may submit a Form

cation if it has actual knowledge or has reason foreign government W-8EXP. 8804-C to a partnership at any time during the

to know that any information on the form is in- foreign grantor partnership's year and prior to the partnership's

correct or unreliable. trust** W-8IMY. filing of its Form 8804. An updated certificate is

If a partnership does not receive a Form certain foreign trust required when the facts or representations

W-9 (or similar documentation), the partnership or foreign estate W-8BEN. made in the original certificate have changed or

must presume that the partner is a foreign per- a status report is required.

son. foreign tax-exempt For more information, see the Instructions

organization for Form 8804-C.

Foreign Partner (including a private Tax rate. The withholding tax rate on a part-

foundation) W-8EXP. ner's share of effectively connected income is

A partner that is a foreign person should pro- nominee W-8 used by 37% for noncorporate partners and 21% for cor-

vide the appropriate Form W-8 (as shown in beneficial owner. porate partners. However, the partnership may

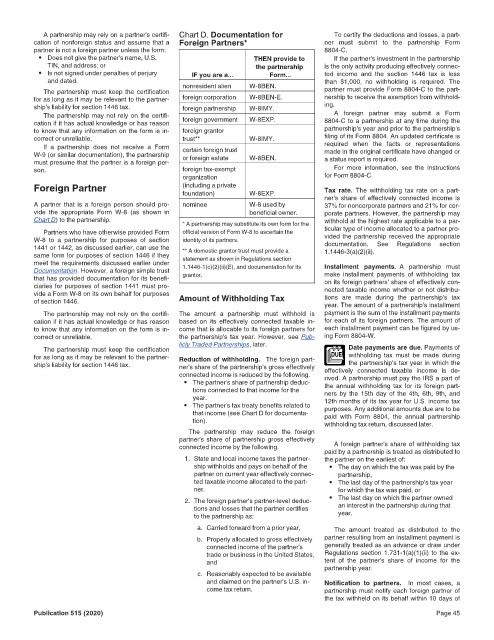

Chart D) to the partnership. * A partnership may substitute its own form for the withhold at the highest rate applicable to a par-

Partners who have otherwise provided Form official version of Form W-8 to ascertain the ticular type of income allocated to a partner pro-

W-8 to a partnership for purposes of section identity of its partners. vided the partnership received the appropriate

1441 or 1442, as discussed earlier, can use the ** A domestic grantor trust must provide a documentation. See Regulations section

1.1446-3(a)(2)(ii).

same form for purposes of section 1446 if they statement as shown in Regulations section

meet the requirements discussed earlier under 1.1446-1(c)(2)(ii)(E), and documentation for its Installment payments. A partnership must

Documentation. However, a foreign simple trust make installment payments of withholding tax

that has provided documentation for its benefi- grantor. on its foreign partners' share of effectively con-

ciaries for purposes of section 1441 must pro- nected taxable income whether or not distribu-

vide a Form W-8 on its own behalf for purposes tions are made during the partnership's tax

of section 1446. Amount of Withholding Tax year. The amount of a partnership's installment

The partnership may not rely on the certifi- The amount a partnership must withhold is payment is the sum of the installment payments

cation if it has actual knowledge or has reason based on its effectively connected taxable in- for each of its foreign partners. The amount of

to know that any information on the form is in- come that is allocable to its foreign partners for each installment payment can be figured by us-

correct or unreliable. the partnership's tax year. However, see Pub- ing Form 8804-W.

licly Traded Partnerships, later.

The partnership must keep the certification Date payments are due. Payments of

for as long as it may be relevant to the partner- Reduction of withholding. The foreign part- DUE withholding tax must be made during

ship's liability for section 1446 tax. ner's share of the partnership's gross effectively the partnership's tax year in which the

connected income is reduced by the following. effectively connected taxable income is de-

rived. A partnership must pay the IRS a part of

• The partner's share of partnership deduc- the annual withholding tax for its foreign part-

tions connected to that income for the ners by the 15th day of the 4th, 6th, 9th, and

year. 12th months of its tax year for U.S. income tax

• The partner's tax treaty benefits related to purposes. Any additional amounts due are to be

that income (see Chart D for documenta- paid with Form 8804, the annual partnership

tion). withholding tax return, discussed later.

The partnership may reduce the foreign

partner's share of partnership gross effectively

A foreign partner's share of withholding tax

connected income by the following. paid by a partnership is treated as distributed to

1. State and local income taxes the partner- the partner on the earliest of:

ship withholds and pays on behalf of the • The day on which the tax was paid by the

partner on current year effectively connec- partnership,

ted taxable income allocated to the part- • The last day of the partnership's tax year

ner. for which the tax was paid, or

2. The foreign partner's partner-level deduc- • The last day on which the partner owned

tions and losses that the partner certifies an interest in the partnership during that

to the partnership as: year.

a. Carried forward from a prior year, The amount treated as distributed to the

b. Properly allocated to gross effectively partner resulting from an installment payment is

connected income of the partner's generally treated as an advance or draw under

trade or business in the United States, Regulations section 1.731-1(a)(1)(ii) to the ex-

and tent of the partner's share of income for the

c. Reasonably expected to be available partnership year.

and claimed on the partner's U.S. in- Notification to partners. In most cases, a

come tax return. partnership must notify each foreign partner of

the tax withheld on its behalf within 10 days of

Publication 515 (2020) Page 45