Page 161 - TaxAdviser_Jan_Apr23_Neat

P. 161

is generally based on the individual’s

income from two years prior. Lifelong If a Medicare beneficiary receives a

penalties for failure to enroll when first

eligible are to be avoided. This research determination or decision regarding benefits

summarizes the applicable statutes that they do not agree with, the SSA has an

and regulations and how planning may

be effective. appeal process to follow and make a request

for reconsideration.

Basic Part B premium

As a starting point, one needs to

understand the determination of the Income-related monthly to be provided a copy of the amended

premium. As noted in the Centers for adjustment amount tax return as filed. A copy of the IRS’s

Medicare & Medicaid Services’ Sept. To determine the IRMAA, the Social acknowledgment or notice that the

27, 2022, announcement, the 2023 Part Security Administration (SSA) obtains amended return has been accepted

B premiums range from $164.90 to the Medicare beneficiary’s modified ad- is also required to be submitted to

$560.50 per month. According to the justed gross income (MAGI) from the the SSA.

announcement, only 7% of beneficiaries IRS for two years prior to the premium

pay more than the basic premium. For year. If the IRS is unable to provide MAGI for Medicare

that 7%, the premium is structured that information because a return has premium purposes

as a two-part assessment: the basic been extended or for another reason MAGI specific to Medicare is defined

assessment of $164.90 (down from such as nonfiling, it will provide the tax in Section 1839(i)(4) of the Social

$170.10 in 2022), plus what is called information for the third year preceding Security Act by taking total adjusted

the income-related monthly adjustment the premium year. If the SSA is relying gross income from the most recent

amount (IRMAA)). on information from three years earlier, federal tax return provided to the SSA

the IRMAA will be adjusted once the (for the 2023 Medicare Part B and D

Medicare Part B income-related MAGI for two years prior to the pre- premiums, 2021 Form 1040-SR, U.S.

monthly adjustment amounts mium year becomes available. Tax Return for Seniors, line 11) and

A beneficiary’s Part B monthly premi- If the Medicare beneficiary files adding back other income that is tax-

um is based on their income. The pre- an amended tax return that changes exempt under the Internal Revenue

mium amounts, including the IRMAA, the MAGI calculation and would Code (IRC).

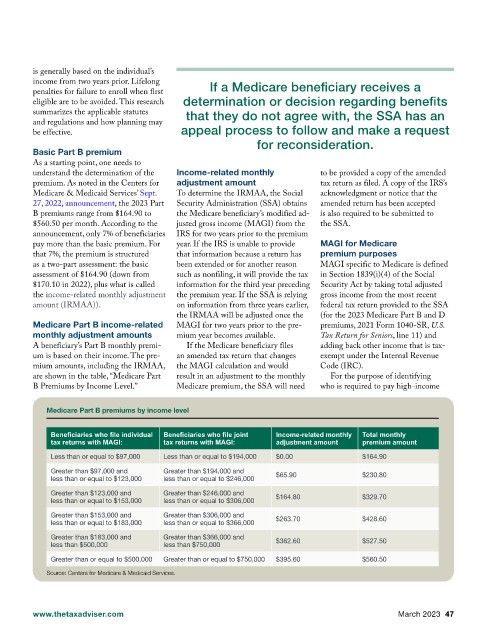

are shown in the table, “Medicare Part result in an adjustment to the monthly For the purpose of identifying

B Premiums by Income Level.” Medicare premium, the SSA will need who is required to pay high-income

Medicare Part B premiums by income level

Beneficiaries who file individual Beneficiaries who file joint Income-related monthly Total monthly

tax returns with MAGI: tax returns with MAGI: adjustment amount premium amount

Less than or equal to $97,000 Less than or equal to $194,000 $0.00 $164.90

Greater than $97,000 and Greater than $194,000 and $65.90 $230.80

less than or equal to $123,000 less than or equal to $246,000

Greater than $123,000 and Greater than $246,000 and $164.80 $329.70

less than or equal to $153,000 less than or equal to $306,000

Greater than $153,000 and Greater than $306,000 and $263.70 $428.60

less than or equal to $183,000 less than or equal to $366,000

Greater than $183,000 and Greater than $366,000 and $362.60 $527.50

less than $500,000 less than $750,000

Greater than or equal to $500,000 Greater than or equal to $750,000 $395.60 $560.50

Source: Centers for Medicare & Medicaid Services.

www.thetaxadviser.com March 2023 47