Page 21 - TaxAdviser_Jan_Apr23_Neat

P. 21

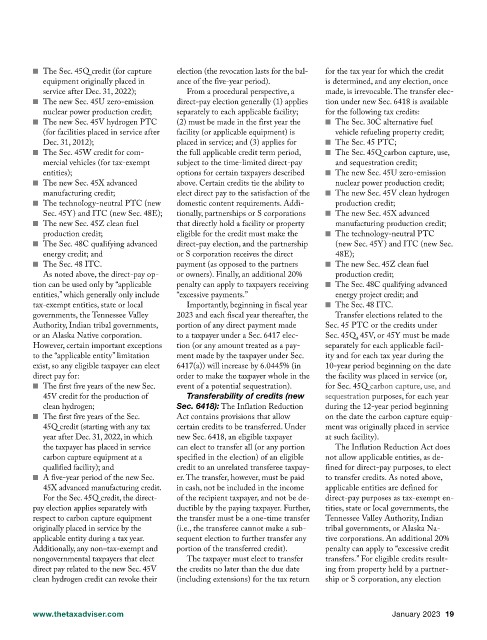

■ The Sec. 45Q credit (for capture election (the revocation lasts for the bal- for the tax year for which the credit

equipment originally placed in ance of the five-year period). is determined, and any election, once

service after Dec. 31, 2022); From a procedural perspective, a made, is irrevocable. The transfer elec-

■ The new Sec. 45U zero-emission direct-pay election generally (1) applies tion under new Sec. 6418 is available

nuclear power production credit; separately to each applicable facility; for the following tax credits:

■ The new Sec. 45V hydrogen PTC (2) must be made in the first year the ■ The Sec. 30C alternative fuel

(for facilities placed in service after facility (or applicable equipment) is vehicle refueling property credit;

Dec. 31, 2012); placed in service; and (3) applies for ■ The Sec. 45 PTC;

■ The Sec. 45W credit for com- the full applicable credit term period, ■ The Sec. 45Q carbon capture, use,

mercial vehicles (for tax-exempt subject to the time-limited direct-pay and sequestration credit;

entities); options for certain taxpayers described ■ The new Sec. 45U zero-emission

■ The new Sec. 45X advanced above. Certain credits tie the ability to nuclear power production credit;

manufacturing credit; elect direct pay to the satisfaction of the ■ The new Sec. 45V clean hydrogen

■ The technology-neutral PTC (new domestic content requirements. Addi- production credit;

Sec. 45Y) and ITC (new Sec. 48E); tionally, partnerships or S corporations ■ The new Sec. 45X advanced

■ The new Sec. 45Z clean fuel that directly hold a facility or property manufacturing production credit;

production credit; eligible for the credit must make the ■ The technology-neutral PTC

■ The Sec. 48C qualifying advanced direct-pay election, and the partnership (new Sec. 45Y) and ITC (new Sec.

energy credit; and or S corporation receives the direct 48E);

■ The Sec. 48 ITC. payment (as opposed to the partners ■ The new Sec. 45Z clean fuel

As noted above, the direct-pay op- or owners). Finally, an additional 20% production credit;

tion can be used only by “applicable penalty can apply to taxpayers receiving ■ The Sec. 48C qualifying advanced

entities,” which generally only include “excessive payments.” energy project credit; and

tax-exempt entities, state or local Importantly, beginning in fiscal year ■ The Sec. 48 ITC.

governments, the Tennessee Valley 2023 and each fiscal year thereafter, the Transfer elections related to the

Authority, Indian tribal governments, portion of any direct payment made Sec. 45 PTC or the credits under

or an Alaska Native corporation. to a taxpayer under a Sec. 6417 elec- Sec. 45Q, 45V, or 45Y must be made

However, certain important exceptions tion (or any amount treated as a pay- separately for each applicable facil-

to the “applicable entity” limitation ment made by the taxpayer under Sec. ity and for each tax year during the

exist, so any eligible taxpayer can elect 6417(a)) will increase by 6.0445% (in 10-year period beginning on the date

direct pay for: order to make the taxpayer whole in the the facility was placed in service (or,

■ The first five years of the new Sec. event of a potential sequestration). for Sec. 45Q carbon capture, use, and

45V credit for the production of Transferability of credits (new sequestration purposes, for each year

clean hydrogen; Sec. 6418): The Inflation Reduction during the 12-year period beginning

■ The first five years of the Sec. Act contains provisions that allow on the date the carbon capture equip-

45Q credit (starting with any tax certain credits to be transferred. Under ment was originally placed in service

year after Dec. 31, 2022, in which new Sec. 6418, an eligible taxpayer at such facility).

the taxpayer has placed in service can elect to transfer all (or any portion The Inflation Reduction Act does

carbon capture equipment at a specified in the election) of an eligible not allow applicable entities, as de-

qualified facility); and credit to an unrelated transferee taxpay- fined for direct-pay purposes, to elect

■ A five-year period of the new Sec. er. The transfer, however, must be paid to transfer credits. As noted above,

45X advanced manufacturing credit. in cash, not be included in the income applicable entities are defined for

For the Sec. 45Q credit, the direct- of the recipient taxpayer, and not be de- direct-pay purposes as tax-exempt en-

pay election applies separately with ductible by the paying taxpayer. Further, tities, state or local governments, the

respect to carbon capture equipment the transfer must be a one-time transfer Tennessee Valley Authority, Indian

originally placed in service by the (i.e., the transferee cannot make a sub- tribal governments, or Alaska Na-

applicable entity during a tax year. sequent election to further transfer any tive corporations. An additional 20%

Additionally, any non–tax-exempt and portion of the transferred credit). penalty can apply to “excessive credit

nongovernmental taxpayers that elect The taxpayer must elect to transfer transfers.” For eligible credits result-

direct pay related to the new Sec. 45V the credits no later than the due date ing from property held by a partner-

clean hydrogen credit can revoke their (including extensions) for the tax return ship or S corporation, any election

www.thetaxadviser.com January 2023 19