Page 38 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 38

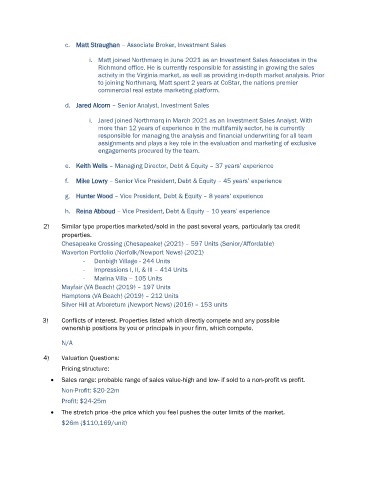

c. Matt Straughan – Associate Broker, Investment Sales

i. Matt joined Northmarq in June 2021 as an Investment Sales Associates in the

Richmond office. He is currently responsible for assisting in growing the sales

activity in the Virginia market, as well as providing in-depth market analysis. Prior

to joining Northmarq, Matt spent 2 years at CoStar, the nations premier

commercial real estate marketing platform.

d. Jared Alcorn – Senior Analyst, Investment Sales

i. Jared joined Northmarq in March 2021 as an Investment Sales Analyst. With

more than 12 years of experience in the multifamily sector, he is currently

responsible for managing the analysis and financial underwriting for all team

assignments and plays a key role in the evaluation and marketing of exclusive

engagements procured by the team.

e. Keith Wells – Managing Director, Debt & Equity – 37 years’ experience

f. Mike Lowry – Senior Vice President, Debt & Equity – 45 years’ experience

g. Hunter Wood – Vice President, Debt & Equity – 8 years’ experience

h. Reina Abboud – Vice President, Debt & Equity – 10 years’ experience

2) Similar type properties marketed/sold in the past several years, particularly tax credit

properties.

Chesapeake Crossing (Chesapeake) (2021) – 597 Units (Senior/Affordable)

Waverton Portfolio (Norfolk/Newport News) (2021)

- Denbigh Village - 244 Units

- Impressions I, II, & III – 414 Units

- Marina Villa – 105 Units

Mayfair (VA Beach) (2019) – 197 Units

Hamptons (VA Beach) (2019) – 212 Units

Silver Hill at Arboretum (Newport News) (2016) – 153 units

3) Conflicts of interest. Properties listed which directly compete and any possible

ownership positions by you or principals in your firm, which compete.

N/A

4) Valuation Questions:

Pricing structure:

• Sales range: probable range of sales value-high and low- if sold to a non-profit vs profit.

Non-Profit: $20-22m

Profit: $24-25m

• The stretch price -the price which you feel pushes the outer limits of the market.

$26m ($110,169/unit)