Page 41 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 41

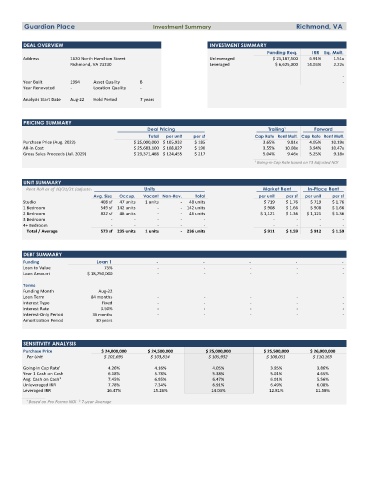

Guardian Place Investment Summary Richmond, VA

DEAL OVERVIEW INVESTMENT SUMMARY

Funding Req. IRR Eq. Mult.

Address 1620 North Hamilton Street Unleveraged $ 25,187,500 6.91% 1.51x

Richmond, VA 23230 Leveraged $ 6,625,000 14.03% 2.22x

-

Year Built 1994 Asset Quality B -

Year Renovated - Location Quality -

Analysis Start Date Aug-22 Hold Period 7 years

PRICING SUMMARY

Deal Pricing Trailing¹ Forward

Total per unit per sf Cap Rate Rent Mult. Cap Rate Rent Mult.

Purchase Price (Aug. 2022) $ 25,000,000 $ 105,932 $ 185 3.65% 9.81x 4.05% 10.19x

All-in Cost $ 25,683,100 $ 108,827 $ 190 3.55% 10.08x 3.94% 10.47x

Gross Sales Proceeds (Jul. 2029) $ 29,371,468 $ 124,455 $ 217 5.04% 9.46x 5.25% 9.18x

¹ Going-in Cap Rate based on T3 Adjusted NOI

UNIT SUMMARY

Rent Roll as of 10/31/21 (adjusted Units Market Rent In-Place Rent

Avg. Size Occup. Vacant Non-Rev. Total per unit per sf per unit per sf

Studio 408 sf 47 units 1 units - 48 units $ 719 $ 1.76 $ 719 $ 1.76

1 Bedroom 549 sf 142 units - - 142 units $ 908 $ 1.66 $ 908 $ 1.66

2 Bedroom 822 sf 46 units - - 46 units $ 1,121 $ 1.36 $ 1,121 $ 1.36

3 Bedroom - - - - - - - - -

4+ Bedroom - - - - - - - - -

Total / Average 573 sf 235 units 1 units - 236 units $ 911 $ 1.59 $ 912 $ 1.59

DEBT SUMMARY

Funding Loan 1 - - - - -

Loan to Value 75% - - - - -

Loan Amount $ 18,750,000 - - - - -

Terms

Funding Month Aug-22

Loan Term 84 months - - - - -

Interest Type Fixed - - - - -

Interest Rate 3.50% - - - - -

Interest-Only Period 36 months - - - - -

Amortization Period 30 years

SENSITIVITY ANALYSIS

Purchase Price $ 24,000,000 $ 24,500,000 $ 25,000,000 $ 25,500,000 $ 26,000,000

Per Unit $ 101,695 $ 103,814 $ 105,932 $ 108,051 $ 110,169

Going-In Cap Rate¹ 4.26% 4.16% 4.05% 3.95% 3.86%

Year 1 Cash on Cash 6.18% 5.78% 5.38% 5.01% 4.65%

Avg. Cash on Cash² 7.45% 6.95% 6.47% 6.01% 5.56%

Unleveraged IRR 7.78% 7.34% 6.91% 6.49% 6.08%

Leveraged IRR 16.47% 15.26% 14.03% 12.81% 11.58%

¹ Based on Pro Forma NOI ² 7-year Average