Page 42 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 42

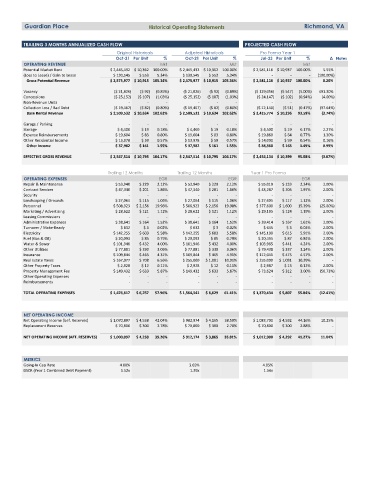

Guardian Place Historical Operating Statements Richmond, VA

TRAILING 3 MONTHS ANNUALIZED CASH FLOW PROJECTED CASH FLOW

Original Historicals Adjusted Historicals Pro Forma Year 1

Oct-21 Per Unit % Oct-21 Per Unit % Jul-23 Per Unit % Δ Notes

OPERATING REVENUE Mkt Mkt Mkt

Potential Market Rent $ 2,445,432 $ 10,362 100.00% $ 2,445,432 $ 10,362 100.00% $ 2,581,116 $ 10,937 100.00% 5.55%

(Loss to Lease) / Gain to Lease $ 130,545 $ 553 5.34% $ 130,545 $ 553 5.34% - - - (100.00%)

Gross Potential Revenue $ 2,575,977 $ 10,915 105.34% $ 2,575,977 $ 10,915 105.34% $ 2,581,116 $ 10,937 100.00% 0.20%

Vacancy ($ 21,826) ($ 92) (0.89%) ($ 21,826) ($ 92) (0.89%) ($ 129,056) ($ 547) (5.00%) 491.30%

Concessions ($ 25,152) ($ 107) (1.03%) ($ 25,152) ($ 107) (1.03%) ($ 24,147) ($ 102) (0.94%) (4.00%)

Non-Revenue Units - - - - - - - - - -

Collection Loss / Bad Debt ($ 19,467) ($ 82) (0.80%) ($ 19,467) ($ 82) (0.80%) ($ 12,140) ($ 51) (0.47%) (37.64%)

Base Rental Revenue $ 2,509,532 $ 10,634 102.62% $ 2,509,532 $ 10,634 102.62% $ 2,415,774 $ 10,236 93.59% (3.74%)

Garage / Parking - - - - - - - - - -

Storage $ 4,400 $ 19 0.18% $ 4,400 $ 19 0.18% $ 4,500 $ 19 0.17% 2.27%

Expense Reimbursements $ 19,604 $ 83 0.80% $ 19,604 $ 83 0.80% $ 19,860 $ 84 0.77% 1.30%

Other Residential Income $ 13,978 $ 59 0.57% $ 13,978 $ 59 0.57% $ 14,000 $ 59 0.54% 0.16%

Other Income $ 37,982 $ 161 1.55% $ 37,982 $ 161 1.55% $ 38,360 $ 163 1.49% 0.99%

EFFECTIVE GROSS REVENUE $ 2,547,514 $ 10,795 104.17% $ 2,547,514 $ 10,795 104.17% $ 2,454,134 $ 10,399 95.08% (3.67%)

Trailing 12 Months Trailing 12 Months Year 1 Pro Forma

OPERATING EXPENSES EGR EGR EGR

Repair & Maintenance $ 53,940 $ 229 2.12% $ 53,940 $ 229 2.12% $ 55,019 $ 233 2.24% 2.00%

Contract Services $ 47,340 $ 201 1.86% $ 47,340 $ 201 1.86% $ 48,287 $ 205 1.97% 2.00%

Security - - - - - - - - - -

Landscaping / Grounds $ 27,064 $ 115 1.06% $ 27,064 $ 115 1.06% $ 27,605 $ 117 1.12% 2.00%

Personnel $ 508,923 $ 2,156 19.98% $ 508,923 $ 2,156 19.98% $ 377,600 $ 1,600 15.39% (25.80%)

Marketing / Advertising $ 28,622 $ 121 1.12% $ 28,622 $ 121 1.12% $ 29,195 $ 124 1.19% 2.00%

Leasing Commissions - - - - - - - - - -

Administrative Expenses $ 38,641 $ 164 1.52% $ 38,641 $ 164 1.52% $ 39,414 $ 167 1.61% 2.00%

Turnover / Make-Ready $ 632 $ 3 0.02% $ 632 $ 3 0.02% $ 645 $ 3 0.03% 2.00%

Electricity $ 142,255 $ 603 5.58% $ 142,255 $ 603 5.58% $ 145,100 $ 615 5.91% 2.00%

Fuel (Gas & Oil) $ 20,093 $ 85 0.79% $ 20,093 $ 85 0.79% $ 20,495 $ 87 0.84% 2.00%

Water & Sewer $ 101,946 $ 432 4.00% $ 101,946 $ 432 4.00% $ 103,985 $ 441 4.24% 2.00%

Other Utilities $ 77,881 $ 330 3.06% $ 77,881 $ 330 3.06% $ 79,438 $ 337 3.24% 2.00%

Insurance $ 109,844 $ 465 4.31% $ 109,844 $ 465 4.31% $ 112,041 $ 475 4.57% 2.00%

Real Estate Taxes $ 167,077 $ 708 6.56% $ 255,000 $ 1,081 10.01% $ 255,000 $ 1,081 10.39% -

Other Property Taxes $ 2,928 $ 12 0.11% $ 2,928 $ 12 0.11% $ 2,987 $ 13 0.12% 2.00%

Property Management Fee $ 149,432 $ 633 5.87% $ 149,432 $ 633 5.87% $ 73,624 $ 312 3.00% (50.73%)

Other Operating Expenses - - - - - - - - - -

Reimbursements - - - - - - - - - -

TOTAL OPERATING EXPENSES $ 1,476,617 $ 6,257 57.96% $ 1,564,541 $ 6,629 61.41% $ 1,370,434 $ 5,807 55.84% (12.41%)

NET OPERATING INCOME

Net Operating Income (bef. Reserves) $ 1,070,897 $ 4,538 42.04% $ 982,974 $ 4,165 38.59% $ 1,083,700 $ 4,592 44.16% 10.25%

Replacement Reserves $ 70,800 $ 300 2.78% $ 70,800 $ 300 2.78% $ 70,800 $ 300 2.88% -

NET OPERATING INCOME (AFT. RESERVES) $ 1,000,097 $ 4,238 39.26% $ 912,174 $ 3,865 35.81% $ 1,012,900 $ 4,292 41.27% 11.04%

METRICS

Going-In Cap Rate 4.00% 3.65% 4.05%

DSCR (Year 1 Combined Debt Payment) 1.52x 1.39x 1.54x