Page 55 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 55

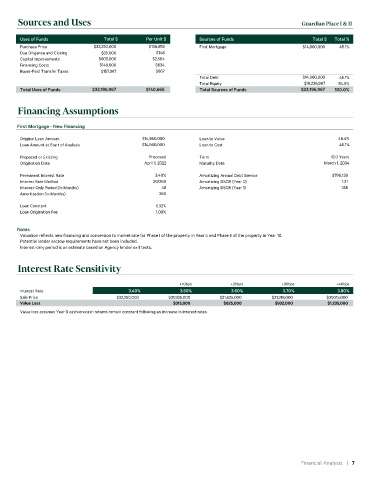

Sources and Uses Guardian Place I & II

uses of Funds Total $ Per unit $ Sources of Funds Total $ Total %

Purchase Price $32,250,000 $136,653 First Mortgage $14,960,000 45.1%

Due Diligence and Closing $35,000 $148 Second Mortgage $0 0.0%

Capital Improvements $605,000 $2,564 Third Mortgage $0 0.0%

Financing Costs $149,600 $634 Fourth Mortgage $0 0.0%

Buyer-Paid Transfer Taxes $157,367 $667 Fifth Mortgage $0 0.0%

Total Debt $14,960,000 45.1%

Total Equity $18,236,967 54.9%

Total Uses of Funds $33,196,967 $140,665 Total Sources of Funds $33,196,967 100.0%

Financing Assumptions

First Mortgage - new Financing

Original Loan Amount $14,960,000 Loan to Value 46.4%

Loan Amount at Start of Analysis $14,960,000 Loan to Cost 45.1%

Proposed or Existing Proposed Term 12.0 Years

Origination Date April 1, 2022 Maturity Date March 1, 2034

Permanent Interest Rate 3.40% Amortizing Annual Debt Service $796,138

Interest Rate Method 30/360 Amortizing DSCR (Year 0) 1.31

Interest-Only Period (In Months) 48 Amortizing DSCR (Year 1) 1.55

Amortization (In Months) 360

Loan Constant 5.32%

Loan Origination Fee 1.00%

notes

Valuation reflects new financing and conversion to market rate for Phase I of the property in Year 4 and Phase II of the property in Year 10.

Potential lender escrow requirements have not been included.

Interest-only period is an estimate based on Agency lender exit tests.

Interest Rate Sensitivity

0.001 +10bps +20bps +30bps +40bps

Interest Rate 3.40% 3.50% 3.60% 3.70% 3.80%

Sale Price $32,250,000 $31,935,000 $31,625,000 $31,318,000 $31,015,000

Value Loss $315,000 $625,000 $932,000 $1,235,000

Value loss assumes Year 0 cash-on-cash returns remain constant following an increase in interest rates.

Financial Analysis | 7