Page 58 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 58

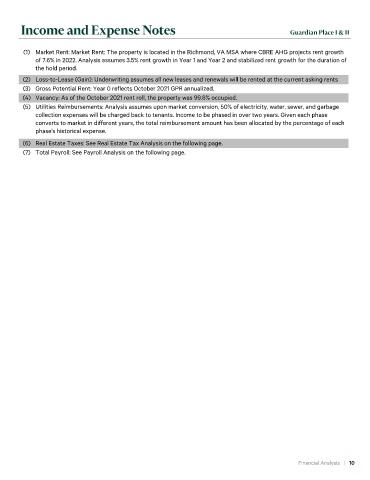

Income and Expense Notes Guardian Place I & II

(1) Market Rent: Market Rent: The property is located in the Richmond, VA MSA where CBRE AHG projects rent growth

of 7.6% in 2022. Analysis assumes 3.5% rent growth in Year 1 and Year 2 and stabilized rent growth for the duration of

the hold period.

(2) Loss-to-Lease (Gain): Underwriting assumes all new leases and renewals will be rented at the current asking rents

over the first 12 months.

(3) Gross Potential Rent: Year 0 reflects October 2021 GPR annualized.

(4) Vacancy: As of the October 2021 rent roll, the property was 99.6% occupied.

(5) Utilities Reimbursements: Analysis assumes upon market conversion, 50% of electricity, water, sewer, and garbage

collection expenses will be charged back to tenants. Income to be phased in over two years. Given each phase

converts to market in different years, the total reimbursement amount has been allocated by the percentage of each

phase's historical expense.

(6) Real Estate Taxes: See Real Estate Tax Analysis on the following page.

(7) Total Payroll: See Payroll Analysis on the following page.

Financial Analysis | 10