Page 59 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 59

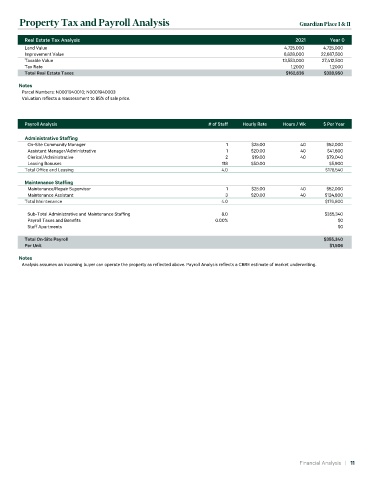

Property Tax and Payroll Analysis Guardian Place I & II

real Estate Tax analysis 2021 year 0

Land Value 4,725,000 4,725,000

Improvement Value 8,828,000 22,687,500

Taxable Value 13,553,000 27,412,500

Tax Rate 1.2000 1.2000

Total Real Estate Taxes $162,636 $328,950

Notes

Parcel Numbers: N0001940010; N0001940003

Valuation reflects a reassessment to 85% of sale price.

Payroll analysis # of Staff Hourly rate Hours / Wk $ Per year

Administrative Staffing

On-Site Community Manager 1 $25.00 40 $52,000

Assistant Manager/Administrative 1 $20.00 40 $41,600

Clerical/Administrative 2 $19.00 40 $79,040

Leasing Bonuses 118 $50.00 $5,900

Total Office and Leasing 4.0 $178,540

Maintenance Staffing

Maintenance/Repair Supervisor 1 $25.00 40 $52,000

Maintenance Assistant 3 $20.00 40 $124,800

Total Maintenance 4.0 $176,800

Sub-Total Administrative and Maintenance Staffing 8.0 $355,340

Payroll Taxes and Benefits 0.00% $0

Staff Apartments $0

Total On-Site Payroll $355,340

Per Unit $1,506

Notes

Analysis assumes an incoming buyer can operate the property as reflected above. Payroll Analysis reflects a CBRE estimate of market underwriting.

Financial Analysis | 11