Page 12 - T:\HR\Div\Employee Services (Cust_None)\Flipbuilder\Benefits Resource Guide FB Project\

P. 12

Dental benefits

The dental plan uses a passive PPO network which means the benefit

coverage is the same whether you see an in or out-of-network provider.

However, you benefit from negotiated discounts with in-network providers.

Should you use an out-of-network provider, your benefits will be subject to

reasonable and customary cost limits. If your out-of-network provider charges

more than that limit, they may balance bill you for the difference.

You may search for an in-network dentist by visiting myuhcdental.com.

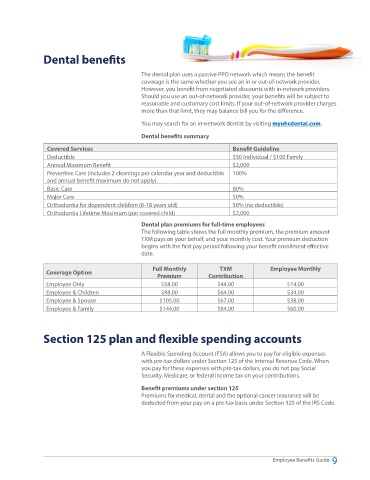

Dental benefits summary

Covered Services Benefit Guideline

Deductible $50 Individual / $100 Family

Annual Maximum Benefit $2,000

Preventive Care (includes 2 cleanings per calendar year and deductible 100%

and annual benefit maximum do not apply)

Basic Care 80%

Major Care 50%

Orthodontia for dependent children (6-18 years old) 50% (no deductible)

Orthodontia Lifetime Maximum (per covered child) $2,000

Dental plan premiums for full-time employees

The following table shows the full monthly premium, the premium amount

TXM pays on your behalf, and your monthly cost. Your premium deduction

begins with the first pay period following your benefit enrollment effective

date.

Full Monthly TXM Employee Monthly

Coverage Option

Premium Contribution

Employee Only $58.00 $44.00 $14.00

Employee & Children $98.00 $64.00 $34.00

Employee & Spouse $105.00 $67.00 $38.00

Employee & Family $144.00 $84.00 $60.00

Section 125 plan and flexible spending accounts

A Flexible Spending Account (FSA) allows you to pay for eligible expenses

with pre-tax dollars under Section 125 of the Internal Revenue Code. When

you pay for these expenses with pre-tax dollars, you do not pay Social

Security, Medicare, or federal income tax on your contributions.

Benefit premiums under section 125

Premiums for medical, dental and the optional cancer insurance will be

deducted from your pay on a pre-tax basis under Section 125 of the IRS Code.

Employee Benefits Guide 9