Page 41 - Insurance Times August 2019

P. 41

who would step in sooner and integrate technology in their Cybersecurity poses another threat to the establishment of

processes. Regulations are a huge concern going on with the above mentioned automated digital systems. It is known

Insurtechs all around the globe. Although various that about 40% of the Fortune 500 companies are insured

governments appreciate that consumers are open to using against the threat of cybersecurity. However, the insurance

technology and saving their premiums, the use of cover is not sufficient to claim the full exposure due to the

technology is moving all away all the risks from the insurer's loss. There is a lack of underwriters in case of cyber risks and

end to the consumer's end. A regulatory framework named they rely on the underwriters of other verticals. With new

Solvency II was introduced in Europe in 2016. types of cyber attacks being discovered each year and the

level of sophistication of cyber attacks, the risks and exposure

This framework demanded certain parameters to be held by of businesses across the globe keeps on increasing day by day.

the Insurtech startups, namely, High Capital Requirements

where a startup needs to build up insurance reserves from The roadblock that lies against the defense from such cyber

the scratch such that in case of immediate settlements of attacks is that the businesses are not well educated in the

multiple claims, the startup does not go bankrupt and holds terms of cyber security. A couple of countries have taken

up due to the excess insurance reserves in the chest. Another huge hits on their respective GDPs (ranging from 0.5%-1.5%

requirement in the minimum SRC (Solvency Risk Capital) of their GDP) due to the rise in such attacks. Hence a need

where the insurance startups are expected to own additional for higher investments in cyber security has been an

amount of own funds on top of the insurance reserves. alarming call for varied businesses all over.

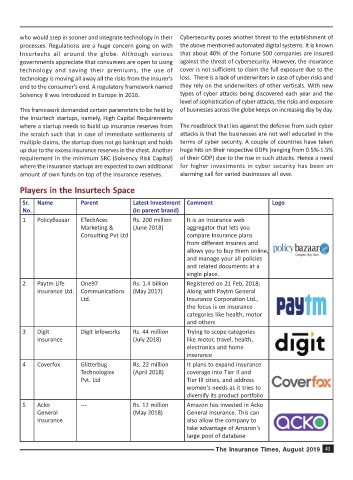

Players in the Insurtech Space

Sr. Name Parent Latest Investment Comment Logo

No. (in parent brand)

1 PolicyBazaar ETechAces Rs. 200 million It is an insurance web

Marketing & (June 2018) aggregator that lets you

Consulting Pvt Ltd compare Insurance plans

from different insurers and

allows you to buy them online,

and manage your all policies

and related documents at a

single place.

2 Paytm Life One97 Rs. 1.4 billion Registered on 21 Feb, 2018;

Insurance Ltd. Communications (May 2017) Along with Paytm General

Ltd. Insurance Corporation Ltd.,

the focus is on insurance

categories like health, motor

and others

3 Digit Digit Infoworks Rs. 44 million Trying to scope categories

Insurance (July 2018) like motor, travel, health,

electronics and home

insurance

4 Coverfox Glitterbug Rs. 22 million It plans to expand insurance

Technologies (April 2018) coverage into Tier II and

Pvt. Ltd Tier III cities, and address

women's needs as it tries to

diversify its product portfolio

5 Acko --- Rs. 12 million Amazon has invested in Acko

General (May 2018) General Insurance. This can

Insurance also allow the company to

take advantage of Amazon's

large pool of database

The Insurance Times, August 2019 41