Page 42 - Insurance Times August 2019

P. 42

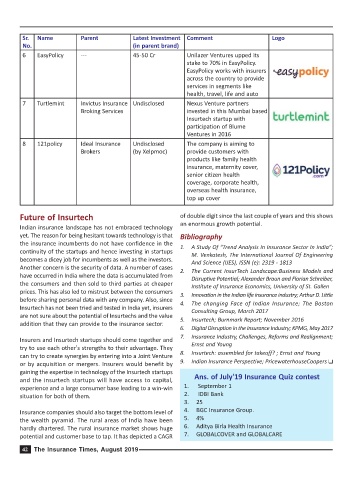

Sr. Name Parent Latest Investment Comment Logo

No. (in parent brand)

6 EasyPolicy --- 45-50 Cr Unilazer Ventures upped its

stake to 70% in EasyPolicy.

EasyPolicy works with insurers

across the country to provide

services in segments like

health, travel, life and auto

7 Turtlemint Invictus Insurance Undisclosed Nexus Venture partners

Broking Services invested in this Mumbai based

Insurtech startup with

participation of Blume

Ventures in 2016

8 121policy Ideal Insurance Undisclosed The company is aiming to

Brokers (by Xelpmoc) provide customers with

products like family health

insurance, maternity cover,

senior citizen health

coverage, corporate health,

overseas health insurance,

top up cover

Future of Insurtech of double digit since the last couple of years and this shows

an enormous growth potential.

Indian insurance landscape has not embraced technology

yet. The reason for being hesitant towards technology is that Bibliography

the insurance incumbents do not have confidence in the 1. A Study Of "Trend Analysis In Insurance Sector In India";

continuity of the startups and hence investing in startups

M. Venkatesh, The International Journal Of Engineering

becomes a dicey job for incumbents as well as the investors. And Science (IJES), ISSN (e): 2319 - 1813

Another concern is the security of data. A number of cases

2. The Current InsurTech Landscape:Business Models and

have occurred in India where the data is accumulated from

Disruptive Potential; Alexander Braun and Florian Schreiber,

the consumers and then sold to third parties at cheaper

Institute of Insurance Economics, University of St. Gallen

prices. This has also led to mistrust between the consumers 3. Innovation in the Indian life insurance industry; Arthur D. Little

before sharing personal data with any company. Also, since 4. The changing Face of Indian Insurance; The Boston

Insurtech has not been tried and tested in India yet, insurers

Consulting Group, March 2017

are not sure about the potential of Insurtechs and the value

5. Insurtech; Burnmark Report; November 2016

addition that they can provide to the insurance sector.

6. Digital Disruption in the Insurance Industry; KPMG, May 2017

7. Insurance Industry, Challenges, Reforms and Realignment;

Insurers and Insurtech startups should come together and

Ernst and Young

try to use each other's strengths to their advantage. They

8. Insurtech: assembled for takeoff? ; Ernst and Young

can try to create synergies by entering into a Joint Venture

9. Indian Insurance Perspective; PricewaterhouseCoopers T

or by acquisition or mergers. Insurers would benefit by

gaining the expertise in technology of the Insurtech startups

and the insurtech startups will have access to capital, Ans. of July'19 Insurance Quiz contest

experience and a large consumer base leading to a win-win 1. September 1

situation for both of them. 2. IDBI Bank

3. 25

Insurance companies should also target the bottom level of 4. BGC Insurance Group.

the wealth pyramid. The rural areas of India have been 5. 4%

hardly chartered. The rural insurance market shows huge 6. Aditya Birla Health Insurance

potential and customer base to tap. It has depicted a CAGR 7. GLOBALCOVER and GLOBALCARE

42 The Insurance Times, August 2019