Page 46 - Insurance Times July 2024

P. 46

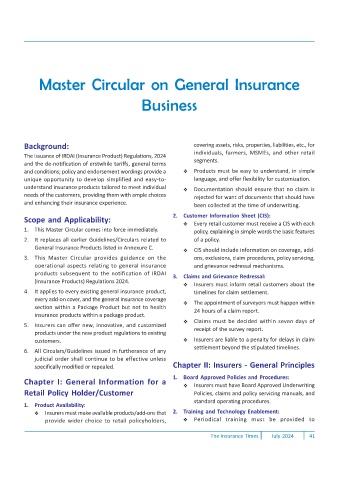

Master Circular on General Insurance

Business

Background: covering assets, risks, properties, liabilities, etc., for

individuals, farmers, MSMEs, and other retail

The issuance of IRDAI (Insurance Product) Regulations, 2024

and the de-notification of erstwhile tariffs, general terms segments.

and conditions; policy and endorsement wordings provide a Products must be easy to understand, in simple

unique opportunity to develop simplified and easy-to- language, and offer flexibility for customization.

understand insurance products tailored to meet individual Documentation should ensure that no claim is

needs of the customers, providing them with ample choices rejected for want of documents that should have

and enhancing their insurance experience. been collected at the time of underwriting.

2. Customer Information Sheet (CIS):

Scope and Applicability:

Every retail customer must receive a CIS with each

1. This Master Circular comes into force immediately. policy, explaining in simple words the basic features

2. It replaces all earlier Guidelines/Circulars related to of a policy.

General Insurance Products listed in Annexure C. CIS should include information on coverage, add-

3. This Master Circular provides guidance on the ons, exclusions, claim procedures, policy servicing,

operational aspects relating to general insurance and grievance redressal mechanisms.

products subsequent to the notification of IRDAI

3. Claims and Grievance Redressal:

(Insurance Products) Regulations 2024.

Insurers must inform retail customers about the

4. It applies to every existing general insurance product, timelines for claim settlement.

every add-on cover, and the general insurance coverage

The appointment of surveyors must happen within

section within a Package Product but not to health

24 hours of a claim report.

insurance products within a package product.

Claims must be decided within seven days of

5. Insurers can offer new, innovative, and customized

receipt of the survey report.

products under the new product regulations to existing

customers. Insurers are liable to a penalty for delays in claim

settlement beyond the stipulated timelines.

6. All Circulars/Guidelines issued in furtherance of any

judicial order shall continue to be effective unless

specifically modified or repealed. Chapter II: Insurers - General Principles

1. Board Approved Policies and Procedures:

Chapter I: General Information for a

Insurers must have Board Approved Underwriting

Retail Policy Holder/Customer Policies, claims and policy servicing manuals, and

standard operating procedures.

1. Product Availability:

Insurers must make available products/add-ons that 2. Training and Technology Enablement:

provide wider choice to retail policyholders, Periodical training must be provided to

The Insurance Times July 2024 41