Page 46 - Banking Finance May 2023

P. 46

ARTICLE

The bonds are structured as a form of insurance-linked Risk Transfer: Catastrophic bonds allow insurers to

security (ILS) and are issued by a special purpose vehicle transfer the financial risk of catastrophic events to the

(SPV), which is created specifically for the purpose of capital markets, reducing their exposure to losses. This

issuing the bonds. The SPV is typically a bankruptcy- allows insurers to manage their risk exposure and

remote entity that is separate from the insurer or improve their financial stability more effectively.

reinsurer that is transferring the risk.

Capital Efficiency: Catastrophic bonds provide a more

The SPV issues bonds to investors in the capital markets, capital-efficient way for insurers to manage their risk

with the proceeds used to invest in low-risk assets, such exposure than traditional reinsurance. Insurers can issue

as government bonds. The investor in turn receives a catastrophic bonds with different maturities, enabling

fixed rate of return over the life of the bond. them to match the duration of the bond with the

duration of the risk.

The proceeds from the sale of the bonds are used to

provide coverage for a specific catastrophic event, such Diversification: Catastrophic bonds offer diversification

as a hurricane or earthquake. benefits to insurers, as their returns are not correlated

with traditional fixed income or equity markets.

If the event does not occur during the term of the bond,

the investors receive their principal and interest

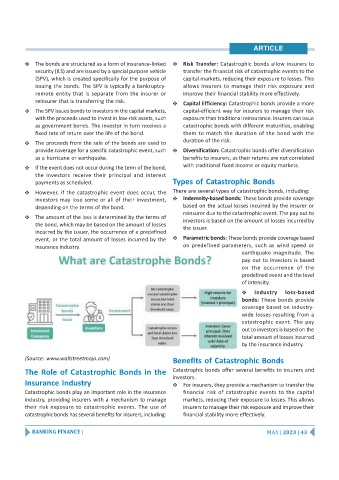

payments as scheduled. Types of Catastrophic Bonds

There are several types of catastrophic bonds, including:

However, if the catastrophic event does occur, the

investors may lose some or all of their investment, Indemnity-based bonds: These bonds provide coverage

based on the actual losses incurred by the insurer or

depending on the terms of the bond.

reinsurer due to the catastrophic event. The pay out to

The amount of the loss is determined by the terms of

investors is based on the amount of losses incurred by

the bond, which may be based on the amount of losses

the issuer.

incurred by the issuer, the occurrence of a predefined

Parametric bonds: These bonds provide coverage based

event, or the total amount of losses incurred by the

on predefined parameters, such as wind speed or

insurance industry.

earthquake magnitude. The

pay out to investors is based

on the occurrence of the

predefined event and the level

of intensity.

Industry loss-based

bonds: These bonds provide

coverage based on industry-

wide losses resulting from a

catastrophic event. The pay

out to investors is based on the

total amount of losses incurred

by the insurance industry.

(Source: www.wallstreetmojo.com)

Benefits of Catastrophic Bonds

Catastrophic bonds offer several benefits to insurers and

The Role of Catastrophic Bonds in the

investors.

Insurance Industry For insurers, they provide a mechanism to transfer the

Catastrophic bonds play an important role in the insurance financial risk of catastrophic events to the capital

industry, providing insurers with a mechanism to manage markets, reducing their exposure to losses. This allows

their risk exposure to catastrophic events. The use of insurers to manage their risk exposure and improve their

catastrophic bonds has several benefits for insurers, including: financial stability more effectively.

BANKING FINANCE | MAY | 2023 | 43