Page 165 - IC46 addendum

P. 165

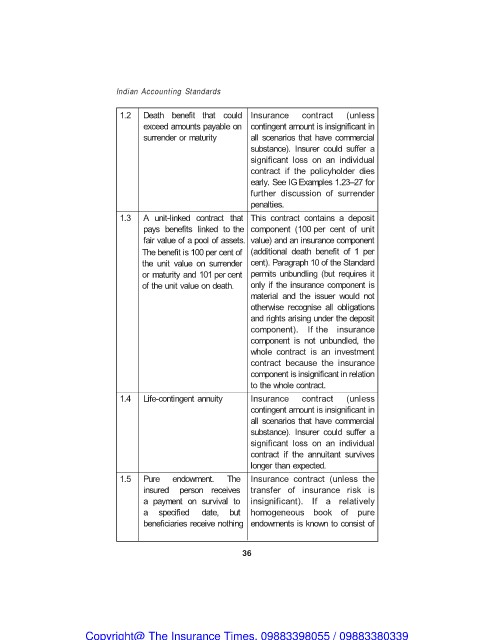

Indian Accounting Standards

1.2 Death benefit that could Insurance contract (unless

exceed amounts payable on contingent amount is insignificant in

surrender or maturity all scenarios that have commercial

substance). Insurer could suffer a

significant loss on an individual

contract if the policyholder dies

early. See IG Examples 1.23–27 for

further discussion of surrender

penalties.

1.3 A unit-linked contract that This contract contains a deposit

pays benefits linked to the component (100 per cent of unit

fair value of a pool of assets. value) and an insurance component

The benefit is 100 per cent of (additional death benefit of 1 per

the unit value on surrender cent). Paragraph 10 of the Standard

or maturity and 101 per cent permits unbundling (but requires it

of the unit value on death. only if the insurance component is

material and the issuer would not

otherwise recognise all obligations

and rights arising under the deposit

component). If the insurance

component is not unbundled, the

whole contract is an investment

contract because the insurance

component is insignificant in relation

to the whole contract.

1.4 Life-contingent annuity Insurance contract (unless

contingent amount is insignificant in

all scenarios that have commercial

substance). Insurer could suffer a

significant loss on an individual

contract if the annuitant survives

longer than expected.

1.5 Pure endowment. The Insurance contract (unless the

insured person receives transfer of insurance risk is

a payment on survival to insignificant). If a relatively

a specified date, but homogeneous book of pure

beneficiaries receive nothing endowments is known to consist of

36

Copyright@ The Insurance Times. 09883398055 / 09883380339