Page 169 - IC46 addendum

P. 169

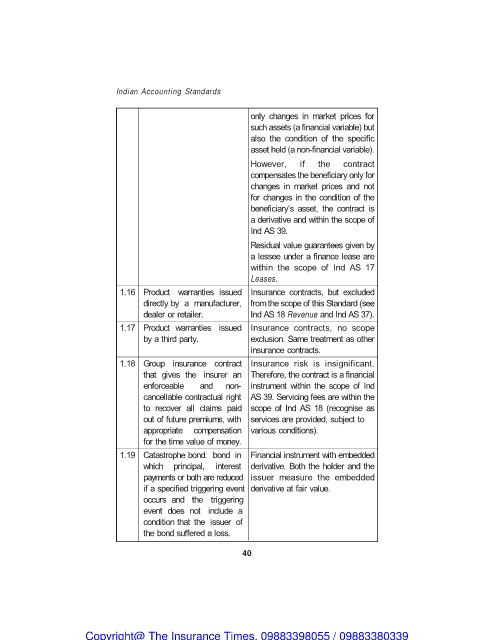

Indian Accounting Standards

only changes in market prices for

such assets (a financial variable) but

also the condition of the specific

asset held (a non-financial variable).

However, if the contract

compensates the beneficiary only for

changes in market prices and not

for changes in the condition of the

beneficiary’s asset, the contract is

a derivative and within the scope of

Ind AS 39.

Residual value guarantees given by

a lessee under a finance lease are

within the scope of Ind AS 17

Leases.

1.16 Product warranties issued Insurance contracts, but excluded

directly by a manufacturer, from the scope of this Standard (see

dealer or retailer. Ind AS 18 Revenue and Ind AS 37).

1.17 Product warranties issued Insurance contracts, no scope

by a third party. exclusion. Same treatment as other

insurance contracts.

1.18 Group insurance contract Insurance risk is insignificant.

that gives the insurer an Therefore, the contract is a financial

enforceable and non- instrument within the scope of Ind

cancellable contractual right AS 39. Servicing fees are within the

to recover all claims paid scope of Ind AS 18 (recognise as

out of future premiums, with services are provided, subject to

appropriate compensation various conditions).

for the time value of money.

1.19 Catastrophe bond: bond in Financial instrument with embedded

which principal, interest derivative. Both the holder and the

payments or both are reduced issuer measure the embedded

if a specified triggering event derivative at fair value.

occurs and the triggering

event does not include a

condition that the issuer of

the bond suffered a loss.

40

Copyright@ The Insurance Times. 09883398055 / 09883380339