Page 172 - IC46 addendum

P. 172

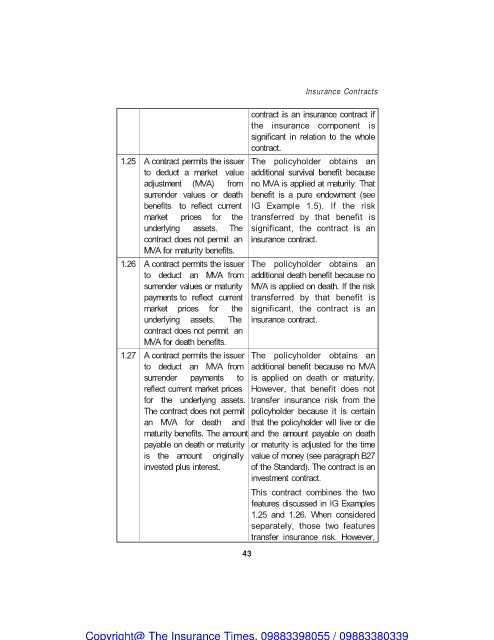

Insurance Contracts

contract is an insurance contract if

the insurance component is

significant in relation to the whole

contract.

1.25 A contract permits the issuer The policyholder obtains an

to deduct a market value additional survival benefit because

adjustment (MVA) from no MVA is applied at maturity. That

surrender values or death benefit is a pure endowment (see

benefits to reflect current IG Example 1.5). If the risk

market prices for the transferred by that benefit is

underlying assets. The significant, the contract is an

contract does not permit an insurance contract.

MVA for maturity benefits.

1.26 A contract permits the issuer The policyholder obtains an

to deduct an MVA from additional death benefit because no

surrender values or maturity MVA is applied on death. If the risk

payments to reflect current transferred by that benefit is

market prices for the significant, the contract is an

underlying assets. The insurance contract.

contract does not permit an

MVA for death benefits.

1.27 A contract permits the issuer The policyholder obtains an

to deduct an MVA from additional benefit because no MVA

surrender payments to is applied on death or maturity.

reflect current market prices However, that benefit does not

for the underlying assets. transfer insurance risk from the

The contract does not permit policyholder because it is certain

an MVA for death and that the policyholder will live or die

maturity benefits. The amount and the amount payable on death

payable on death or maturity or maturity is adjusted for the time

is the amount originally value of money (see paragraph B27

invested plus interest. of the Standard). The contract is an

investment contract.

This contract combines the two

features discussed in IG Examples

1.25 and 1.26. When considered

separately, those two features

transfer insurance risk. However,

43

Copyright@ The Insurance Times. 09883398055 / 09883380339