Page 173 - IC46 addendum

P. 173

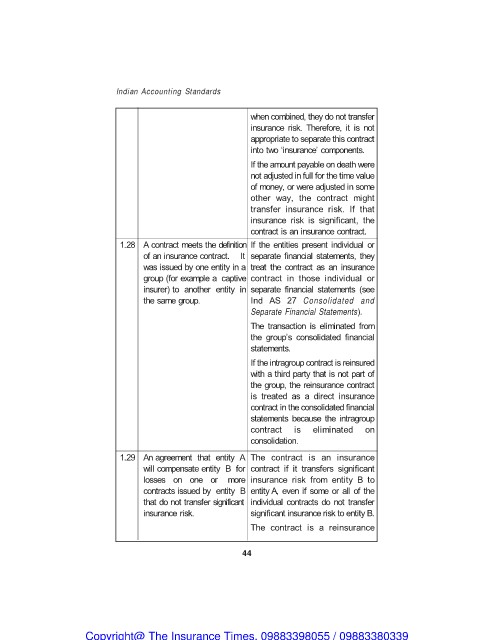

Indian Accounting Standards

when combined, they do not transfer

insurance risk. Therefore, it is not

appropriate to separate this contract

into two ‘insurance’ components.

If the amount payable on death were

not adjusted in full for the time value

of money, or were adjusted in some

other way, the contract might

transfer insurance risk. If that

insurance risk is significant, the

contract is an insurance contract.

1.28 A contract meets the definition If the entities present individual or

of an insurance contract. It separate financial statements, they

was issued by one entity in a treat the contract as an insurance

group (for example a captive contract in those individual or

insurer) to another entity in separate financial statements (see

the same group. Ind AS 27 Consolidated and

Separate Financial Statements).

The transaction is eliminated from

the group’s consolidated financial

statements.

If the intragroup contract is reinsured

with a third party that is not part of

the group, the reinsurance contract

is treated as a direct insurance

contract in the consolidated financial

statements because the intragroup

contract is eliminated on

consolidation.

1.29 An agreement that entity A The contract is an insurance

will compensate entity B for contract if it transfers significant

losses on one or more insurance risk from entity B to

contracts issued by entity B entity A, even if some or all of the

that do not transfer significant individual contracts do not transfer

insurance risk. significant insurance risk to entity B.

The contract is a reinsurance

44

Copyright@ The Insurance Times. 09883398055 / 09883380339