Page 170 - IC46 addendum

P. 170

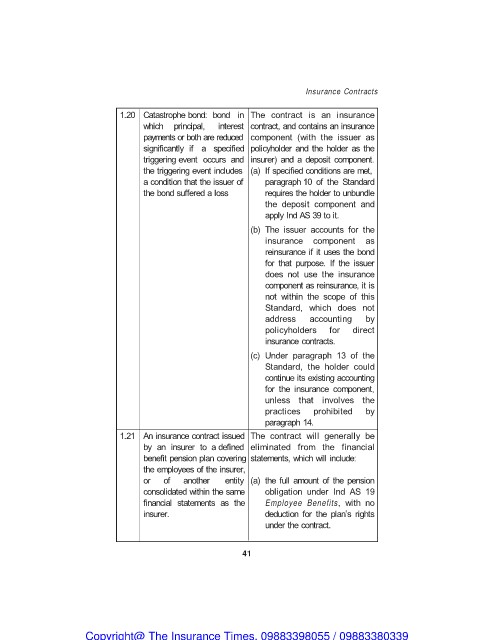

Insurance Contracts

1.20 Catastrophe bond: bond in The contract is an insurance

which principal, interest contract, and contains an insurance

payments or both are reduced component (with the issuer as

significantly if a specified policyholder and the holder as the

triggering event occurs and insurer) and a deposit component.

the triggering event includes (a) If specified conditions are met,

a condition that the issuer of paragraph 10 of the Standard

the bond suffered a loss requires the holder to unbundle

the deposit component and

apply Ind AS 39 to it.

(b) The issuer accounts for the

insurance component as

reinsurance if it uses the bond

for that purpose. If the issuer

does not use the insurance

component as reinsurance, it is

not within the scope of this

Standard, which does not

address accounting by

policyholders for direct

insurance contracts.

(c) Under paragraph 13 of the

Standard, the holder could

continue its existing accounting

for the insurance component,

unless that involves the

practices prohibited by

paragraph 14.

1.21 An insurance contract issued The contract will generally be

by an insurer to a defined eliminated from the financial

benefit pension plan covering statements, which will include:

the employees of the insurer,

or of another entity (a) the full amount of the pension

consolidated within the same obligation under Ind AS 19

financial statements as the Employee Benefits, with no

insurer. deduction for the plan’s rights

under the contract.

41

Copyright@ The Insurance Times. 09883398055 / 09883380339