Page 166 - IC46 addendum

P. 166

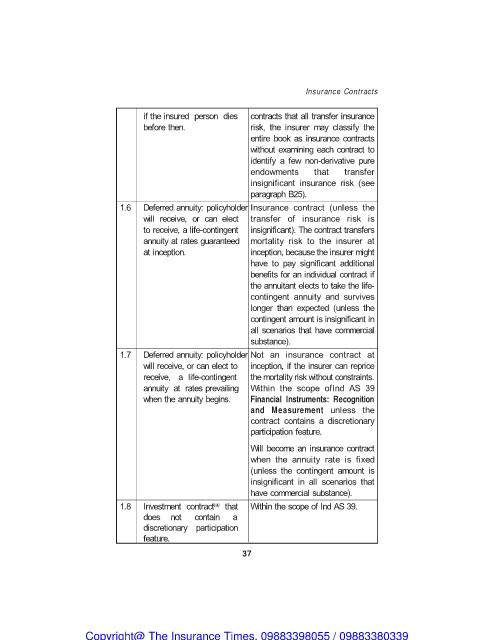

Insurance Contracts

if the insured person dies contracts that all transfer insurance

before then. risk, the insurer may classify the

entire book as insurance contracts

without examining each contract to

identify a few non-derivative pure

endowments that transfer

insignificant insurance risk (see

paragraph B25).

1.6 Deferred annuity: policyholder Insurance contract (unless the

will receive, or can elect transfer of insurance risk is

to receive, a life-contingent insignificant). The contract transfers

annuity at rates guaranteed mortality risk to the insurer at

at inception. inception, because the insurer might

have to pay significant additional

benefits for an individual contract if

the annuitant elects to take the life-

contingent annuity and survives

longer than expected (unless the

contingent amount is insignificant in

all scenarios that have commercial

substance).

1.7 Deferred annuity: policyholder Not an insurance contract at

will receive, or can elect to inception, if the insurer can reprice

receive, a life-contingent the mortality risk without constraints.

annuity at rates prevailing Within the scope ofInd AS 39

when the annuity begins. Financial Instruments: Recognition

and Measurement unless the

contract contains a discretionary

participation feature.

Will become an insurance contract

when the annuity rate is fixed

(unless the contingent amount is

insignificant in all scenarios that

have commercial substance).

1.8 Investment contract(a) that Within the scope of Ind AS 39.

does not contain a

discretionary participation

feature.

37

Copyright@ The Insurance Times. 09883398055 / 09883380339