Page 168 - IC46 addendum

P. 168

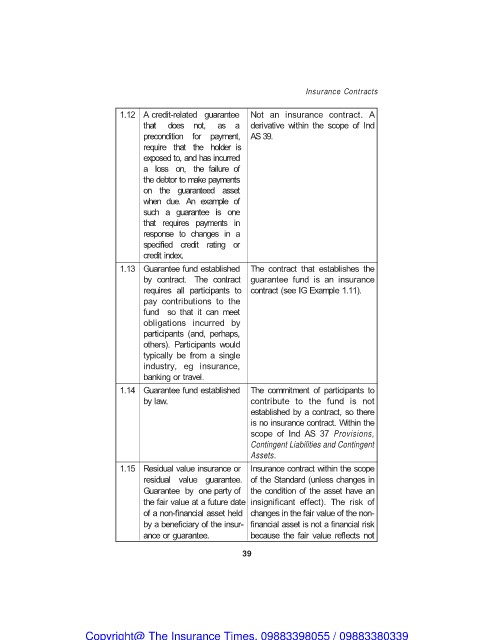

Insurance Contracts

1.12 A credit-related guarantee Not an insurance contract. A

that does not, as a derivative within the scope of Ind

precondition for payment, AS 39.

require that the holder is

exposed to, and has incurred

a loss on, the failure of

the debtor to make payments

on the guaranteed asset

when due. An example of

such a guarantee is one

that requires payments in

response to changes in a

specified credit rating or

credit index.

1.13 Guarantee fund established The contract that establishes the

by contract. The contract guarantee fund is an insurance

requires all participants to contract (see IG Example 1.11).

pay contributions to the

fund so that it can meet

obligations incurred by

participants (and, perhaps,

others). Participants would

typically be from a single

industry, eg insurance,

banking or travel.

1.14 Guarantee fund established The commitment of participants to

by law. contribute to the fund is not

established by a contract, so there

is no insurance contract. Within the

scope of Ind AS 37 Provisions,

Contingent Liabilities and Contingent

Assets.

1.15 Residual value insurance or Insurance contract within the scope

residual value guarantee. of the Standard (unless changes in

Guarantee by one party of the condition of the asset have an

the fair value at a future date insignificant effect). The risk of

of a non-financial asset held changes in the fair value of the non-

by a beneficiary of the insur- financial asset is not a financial risk

ance or guarantee. because the fair value reflects not

39

Copyright@ The Insurance Times. 09883398055 / 09883380339