Page 99 - Insurance Statistics 2021

P. 99

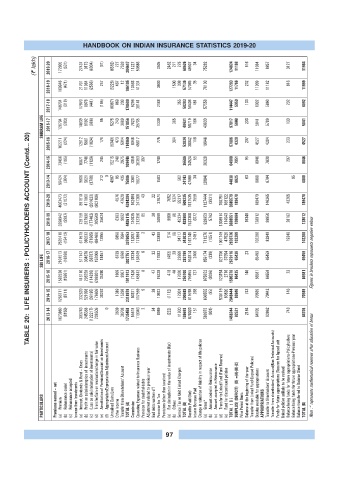

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

(? lakh) 2019-20 172905 (531) 27437 9173 (6034) (91) (6562) 727 7593 204617 11227 50886 3505 2462 271 275 68626 49507 34 75282 124824 11168 816 11984 8857 3127 11984

2018-19 169946 (471) 21701 11984 (2566) 257 (5226) 467 12 196105 10593 41334 3400 1500 308 57136 57065 35 70103 127203 11766 232 11999 11182 816 11999

2017-18 149704 (318) 17970 8978 (441) (195) (6087) 869 209 170689 9299 38141 2488 355 50283 56408 481 57558 114447 5959 133 6092 5860 232 6092

SHRIRAM LIFE 2016-17 120794 (283) 14839 8192 (906) 95 5275 243 3609 151856 7023 39705 1339 365 48431 56719 164 40933 97817 5608 233 5841 5709 133 5841

TABLE 20: LIFE INSURERS : POLICYHOLDERS ACCOUNT (Contd... 20)

2015-16 102211 (224) 12812 5661 (1824) 176 (9340) 473 5014 114960 6048 45617 775 394 52834 38042 118 19646 57806 4320 207 4527 4294 233 4527

2014-15 73466 (185) 10871 7740 (1129) 245 15215 248 2975 109446 4059 30383 397 1748 36586 34524 55 30329 64908 7951 95 8046 7839 207 8046

2013-14 59424 (304) 9806 5021 (3769) 212 0 4887 95 435 75806 3381 18677 1583 502 24143 47698 34 (2894) 44838 6825 63 6888 6794 95 6888

2019-20 4063473 (31072) 891810 411600 (201623) (802108) 4576 47628 4384284 162494 241308 43 22 37674 7052 5324 55317 509235 1617535 7559 1127444 (3831) 768751 168122 3685579 189470 189470 146265 43205 189470

2018-19 3298942 (9907) 729159 327996 (177482) 205509 35624 6383 9892 4426115 134635 212350 85 28 26869 9608 (8) 45334 428900 1523308 6072 929953 5762 1308914 114543 3888551 108664 19348 128012 99850 28162 128012

2017-18 2535419 (19412) 611570 360233 (71665) (68468) 13955 6858 7564 3376053 112087 171884 3 43 23800 514 (8) 34717 343039 1167749 3481 711270 (1051) 1001749 47529 2930726 102288 102288 82940 19348 102288

SBI LIFE 2016-17 2101513 (16268) 511147 304676 (56787) 152006 18457 6739 6268 3027751 78334 164649 6 32 17983 (483) 20 22658 283199 952614 2406 859174 (338) 827706 37554 2679116 65436 23 65459 65459 65459 Figures in brackets represents negative values

2015-16 1582536 (15991) 416110 296258 (114236) (299301) 35260 1969 9307 1911913 71426 145813 8 47 15328 410 48 17020 250100 795955 737 675852 (3036) 123154 2716 1595378 66435 146 66581 66558 23 66581

2014-15 1286711 (8711) 332620 521998 (39195) 178606 30262 1389 15298 2318979 60371 117559 9 38 10922 (1112) 12901 200688 819768 268 606555 (85) 538119 83820 2048444 69846 743 70589 70442 146 70589

2013-14 1073860 (8150) 303743 245368 (122217) 208506 0 3639 30708 1735458 55618 110343 2 34 8989 (222) 11930 186693 878020 151 588973 (901) 1466244 82521 2184 84705 83962 743 84705

PARTICULARS Premiums earned – net Premium (a) Reinsurance ceded (b) Reinsurance accepted (c) Income from Investments Interest, Dividends & Rent – Gross (a) Profit on sale/redemption of investments (b) (Loss on sale/ redemption of investments) (c) Transfer/Gain on revaluation/change in fair value (d) Amortization of Premium/Discount on Investments (e) Appropriation/Expropriation Adjustment Account (f) Unrealised Gains/Loss Other Inco

97