Page 54 - 2019-20 CAFR

P. 54

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

1. Summary of Significant Accounting Policies (continued)

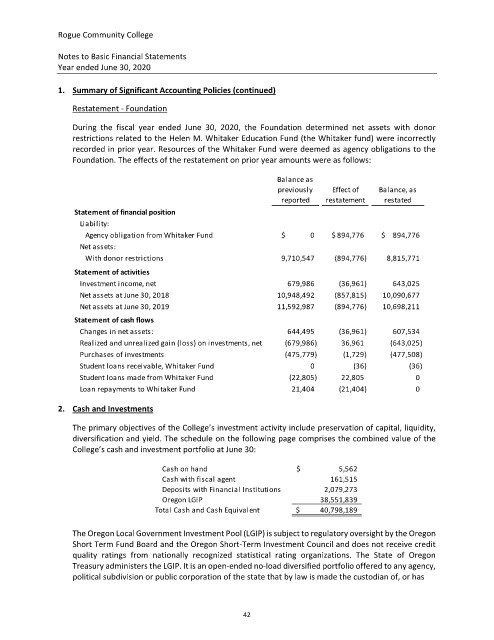

Restatement ‐ Foundation

During the fiscal year ended June 30, 2020, the Foundation determined net assets with donor

restrictions related to the Helen M. Whitaker Education Fund (the Whitaker fund) were incorrectly

recorded in prior year. Resources of the Whitaker Fund were deemed as agency obligations to the

Foundation. The effects of the restatement on prior year amounts were as follows:

Balance as

previously Effect of Balance, as

reported restatement restated

o

f

Statement financial position

Liability:

Agency obligation from Whitaker Fund $ 0 $ 894,776 $ 894,776

Net assets:

With donor restrictions 9,710,547 (894,776) 8,815,771

f

o

Statement activities

Investment income, net 679,986 (36,961) 643,025

Net assets at June 30, 2018 10,948,492 (857,815) 10,090,677

Net assets at June 30, 2019 11,592,987 (894,776) 10,698,211

o

Statement cash flows

f

n

i

Changes net assets: 644,495 (36,961) 607,534

Realized and unrealized gain (loss) on investments, net (679,986) 36,961 (643,025)

o

f

Purchases investments (475,779) (1,729) (477,508)

Student loans receivable, Whitaker Fund 0 (36) (36)

Student loans made from Whitaker Fund (22,805) 22,805 0

Loan repayments to Whitaker Fund 21,404 (21,404) 0

2. Cash and Investments

The primary objectives of the College’s investment activity include preservation of capital, liquidity,

diversification and yield. The schedule on the following page comprises the combined value of the

College’s cash and investment portfolio at June 30:

Cash on hand $ 5,562

Cash with fiscal agent 161,515

Deposits with Financial Institutions 2,079,273

Oregon LGIP 38,551,839

Total Cash and Cash Equivalent $ 40,798,189

The Oregon Local Government Investment Pool (LGIP) is subject to regulatory oversight by the Oregon

Short Term Fund Board and the Oregon Short‐Term Investment Council and does not receive credit

quality ratings from nationally recognized statistical rating organizations. The State of Oregon

Treasury administers the LGIP. It is an open‐ended no‐load diversified portfolio offered to any agency,

political subdivision or public corporation of the state that by law is made the custodian of, or has

42