Page 58 - 2019-20 CAFR

P. 58

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

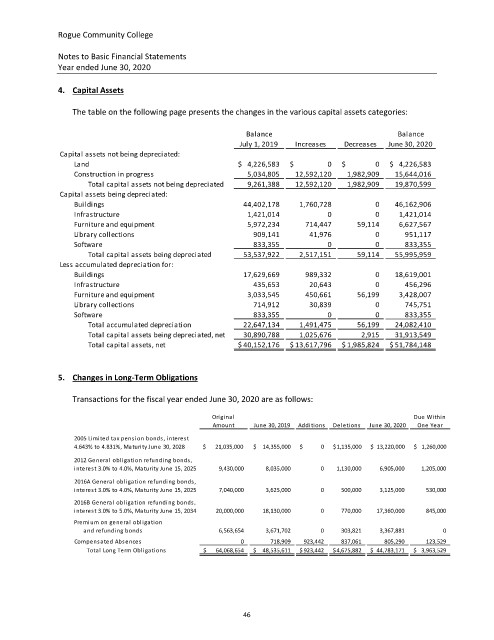

4. Capital Assets

The table on the following page presents the changes in the various capital assets categories:

Balance Balance

July 1, 2019 Increases Decreases June 30, 2020

Capital assets not being depreciated:

Land $ 4,226,583 $ 0 $ 0 $ 4,226,583

Construction in progress 5,034,805 12,592,120 1,982,909 15,644,016

Total capital assets not being depreciated 9,261,388 12,592,120 1,982,909 19,870,599

Capital assets being depreciated:

Buildings 44,402,178 1,760,728 0 46,162,906

Infrastructure 1,421,014 0 0 1,421,014

Furniture and equipment 5,972,234 714,447 59,114 6,627,567

Library collections 909,141 41,976 0 951,117

Software 833,355 0 0 833,355

Total capital assets being depreciated 53,537,922 2,517,151 59,114 55,995,959

Less accumulated depreciation for:

Buildings 17,629,669 989,332 0 18,619,001

Infrastructure 435,653 20,643 0 456,296

Furniture and equipment 3,033,545 450,661 56,199 3,428,007

Library collections 714,912 30,839 0 745,751

Software 833,355 0 0 833,355

Total accumulated depreciation 22,647,134 1,491,475 56,199 24,082,410

Total capital assets being depreciated, net 30,890,788 1,025,676 2,915 31,913,549

Total capital assets, net $ 40,152,176 $ 13,617,796 $ 1,985,824 $ 51,784,148

5. Changes in Long-Term Obligations

Transactions for the fiscal year ended June 30, 2020 are as follows:

Original Due Within

Amount June 30, 2019 Additions Deletions June 30, 2020 One Year

2005 Limited tax pension bonds, interest

4.643% to 4.831%, Maturity June 30, 2028 $ 21,035,000 $ 14,355,000 $ 0 $ 1,135,000 $ 13,220,000 $ 1,260,000

2012 General obligation refunding bonds,

interest 3.0% to 4.0%, Maturity June 15, 2025 9,430,000 8,035,000 0 1,130,000 6,905,000 1,205,000

2016A General obligation refunding bonds,

interest 3.0% to 4.0%, Maturity June 15, 2025 7,040,000 3,625,000 0 500,000 3,125,000 530,000

2016B General obligation refunding bonds,

interest 3.0% to 5.0%, Maturity June 15, 2034 20,000,000 18,130,000 0 770,000 17,360,000 845,000

Premium on general obligation

and refunding bonds 6,563,654 3,671,702 0 303,821 3,367,881 0

Compensated Absences 0 718,909 923,442 837,061 805,290 123,529

Total Long Term Obligations $ 64,068,654 $ 48,535,611 $ 923,442 $ 4,675,882 $ 44,783,171 $ 3,963,529

46