Page 59 - 2019-20 CAFR

P. 59

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

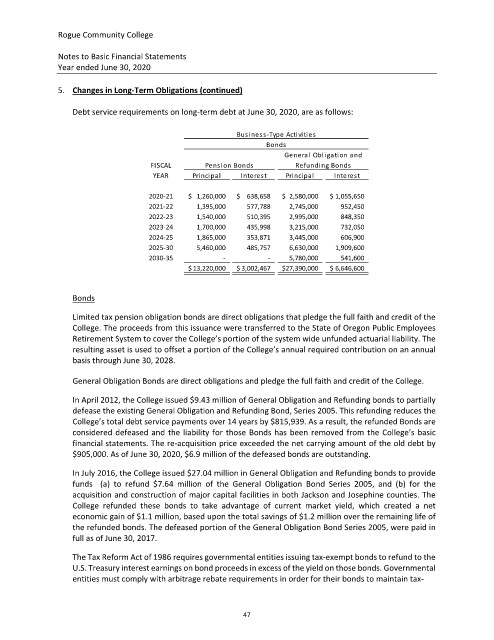

5. Changes in Long‐Term Obligations (continued)

Debt service requirements on long‐term debt at June 30, 2020, are as follows:

Business‐Type Activities

Bonds

General Obligation and

FISCAL Pens ion Bonds Refundi ng Bonds

YEAR Principal Interest Principal Interest

2020‐21 $ 1,260,000 $ 638,658 $ 2,580,000 $ 1,055,650

2021‐22 1,395,000 577,788 2,745,000 952,450

2022‐23 1,540,000 510,395 2,995,000 848,350

2023‐24 1,700,000 435,998 3,215,000 732,050

2024‐25 1,865,000 353,871 3,445,000 606,900

2025‐30 5,460,000 485,757 6,630,000 1,909,600

2030‐35 ‐ ‐ 5,780,000 541,600

$ 13,220,000 $ 3,002,467 $27,390,000 $ 6,646,600

Bonds

Limited tax pension obligation bonds are direct obligations that pledge the full faith and credit of the

College. The proceeds from this issuance were transferred to the State of Oregon Public Employees

Retirement System to cover the College’s portion of the system wide unfunded actuarial liability. The

resulting asset is used to offset a portion of the College’s annual required contribution on an annual

basis through June 30, 2028.

General Obligation Bonds are direct obligations and pledge the full faith and credit of the College.

In April 2012, the College issued $9.43 million of General Obligation and Refunding bonds to partially

defease the existing General Obligation and Refunding Bond, Series 2005. This refunding reduces the

College’s total debt service payments over 14 years by $815,939. As a result, the refunded Bonds are

considered defeased and the liability for those Bonds has been removed from the College’s basic

financial statements. The re‐acquisition price exceeded the net carrying amount of the old debt by

$905,000. As of June 30, 2020, $6.9 million of the defeased bonds are outstanding.

In July 2016, the College issued $27.04 million in General Obligation and Refunding bonds to provide

funds (a) to refund $7.64 million of the General Obligation Bond Series 2005, and (b) for the

acquisition and construction of major capital facilities in both Jackson and Josephine counties. The

College refunded these bonds to take advantage of current market yield, which created a net

economic gain of $1.1 million, based upon the total savings of $1.2 million over the remaining life of

the refunded bonds. The defeased portion of the General Obligation Bond Series 2005, were paid in

full as of June 30, 2017.

The Tax Reform Act of 1986 requires governmental entities issuing tax‐exempt bonds to refund to the

U.S. Treasury interest earnings on bond proceeds in excess of the yield on those bonds. Governmental

entities must comply with arbitrage rebate requirements in order for their bonds to maintain tax‐

47