Page 56 - 2019-20 CAFR

P. 56

Rogue Community College

Notes to Basic Financial Statements

Year ended June 30, 2020

2. Cash and Investments (continued)

Custodial Credit Risk – Investments

The College has a Board approved investment policy, which states that the President shall appoint an

Investment Officer who will perform specific investment functions for the College. Should a counter-

party fail, there is a risk that the College would not be able to recover the value of its investments that

are held by an outside party. To minimize this risk, securities purchased through any of the authorized,

non-bank broker-dealers are held by an independent third-party safekeeping institution.

As of June 30, 2020, the College had $0 invested in various investment instruments including time

deposits. The College has no custodial credit risk at this time.

Foundation Cash and Investments

The Rogue Community College Foundation reported cash and cash equivalents of $237,514 as of June

30, 2020. The Foundation maintains cash balances at a single financial institution. The Federal Deposit

Insurance Corporation insures account balances at each institution for amounts up to $250,000. At

June 30, 2020, the bank balance of cash totaled $330,010, leaving the $80,010 not covered by the

FDIC.

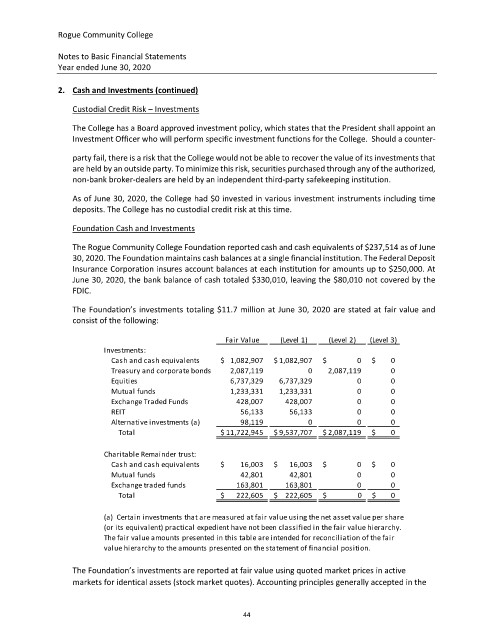

The Foundation’s investments totaling $11.7 million at June 30, 2020 are stated at fair value and

consist of the following:

Fair Value (Level 1) (Level 2) (Level 3)

Investments:

Cash and cash equivalents $ 1,082,907 $ 1,082,907 $ 0 $ 0

Treasury and corporate bonds 2,087,119 0 2,087,119 0

Equities 6,737,329 6,737,329 0 0

Mutual funds 1,233,331 1,233,331 0 0

Exchange Traded Funds 428,007 428,007 0 0

REIT 56,133 56,133 0 0

Alternative investments (a) 98,119 0 0 0

Total $ 11,722,945 $ 9,537,707 $ 2,087,119 $ 0

Charitable Remainder trust:

Cash and cash equivalents $ 16,003 $ 16,003 $ 0 $ 0

Mutual funds 42,801 42,801 0 0

Exchange traded funds 163,801 163,801 0 0

Total $ 222,605 $ 222,605 $ 0 $ 0

(a) Certain investments that are measured at fair value using the net asset value per share

(or its equivalent) practical expedient have not been classified in the fair value hierarchy.

The fair value amounts presented in this table are intended for reconciliation of the fair

value hierarchy to the amounts presented on the statement of financial position.

The Foundation’s investments are reported at fair value using quoted market prices in active

markets for identical assets (stock market quotes). Accounting principles generally accepted in the

44