Page 571 - Microeconomics, Fourth Edition

P. 571

c13marketstructureandcompetition.qxd 7/30/10 10:44 AM Page 545

13.2 OLIGOPOLY WITH HOMOGENEOUS PRODUCTS 545

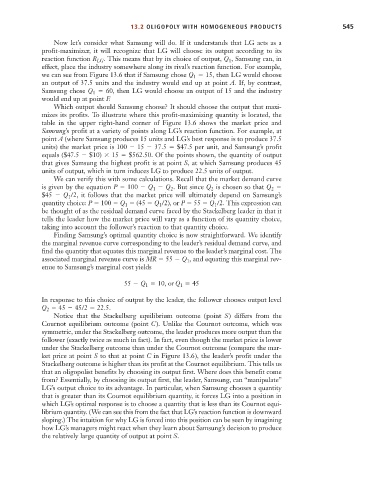

Now let’s consider what Samsung will do. If it understands that LG acts as a

profit-maximizer, it will recognize that LG will choose its output according to its

. This means that by its choice of output, Q , Samsung can, in

reaction function R LG 1

effect, place the industry somewhere along its rival’s reaction function. For example,

we can see from Figure 13.6 that if Samsung chose Q 15, then LG would choose

1

an output of 37.5 units and the industry would end up at point A. If, by contrast,

Samsung chose Q 60, then LG would choose an output of 15 and the industry

1

would end up at point F.

Which output should Samsung choose? It should choose the output that maxi-

mizes its profits. To illustrate where this profit-maximizing quantity is located, the

table in the upper right-hand corner of Figure 13.6 shows the market price and

Samsung’s profit at a variety of points along LG’s reaction function. For example, at

point A (where Samsung produces 15 units and LG’s best response is to produce 37.5

units) the market price is 100 15 37.5 $47.5 per unit, and Samsung’s profit

equals ($47.5 $10) 15 $562.50. Of the points shown, the quantity of output

that gives Samsung the highest profit is at point S, at which Samsung produces 45

units of output, which in turn induces LG to produce 22.5 units of output.

We can verify this with some calculations. Recall that the market demand curve

is given by the equation P 100 Q Q . But since Q is chosen so that Q

1

2

2

2

$45 Q /2, it follows that the market price will ultimately depend on Samsung’s

1

quantity choice: P 100 Q (45 Q /2), or P 55 Q /2. This expression can

1

1

1

be thought of as the residual demand curve faced by the Stackelberg leader in that it

tells the leader how the market price will vary as a function of its quantity choice,

taking into account the follower’s reaction to that quantity choice.

Finding Samsung’s optimal quantity choice is now straightforward. We identify

the marginal revenue curve corresponding to the leader’s residual demand curve, and

find the quantity that equates this marginal revenue to the leader’s marginal cost. The

associated marginal revenue curve is MR 55 Q , and equating this marginal rev-

1

enue to Samsung’s marginal cost yields

55 Q 10, or Q 45

1

1

In response to this choice of output by the leader, the follower chooses output level

Q 45 45/2 22.5.

2

Notice that the Stackelberg equilibrium outcome (point S) differs from the

Cournot equilibrium outcome (point C). Unlike the Cournot outcome, which was

symmetric, under the Stackelberg outcome, the leader produces more output than the

follower (exactly twice as much in fact). In fact, even though the market price is lower

under the Stackelberg outcome than under the Cournot outcome (compare the mar-

ket price at point S to that at point C in Figure 13.6), the leader’s profit under the

Stackelberg outcome is higher than its profit at the Cournot equilibrium. This tells us

that an oligopolist benefits by choosing its output first. Where does this benefit come

from? Essentially, by choosing its output first, the leader, Samsung, can “manipulate”

LG’s output choice to its advantage. In particular, when Samsung chooses a quantity

that is greater than its Cournot equilibrium quantity, it forces LG into a position in

which LG’s optimal response is to choose a quantity that is less than its Cournot equi-

librium quantity. (We can see this from the fact that LG’s reaction function is downward

sloping.) The intuition for why LG is forced into this position can be seen by imagining

how LG’s managers might react when they learn about Samsung’s decision to produce

the relatively large quantity of output at point S.