Page 656 - Microeconomics, Fourth Edition

P. 656

c15riskandinformation.qxd 8/16/10 11:10 AM Page 630

630 CHAPTER 15 RISK AND INFORMATION

Reservoir is large Oil company's payoff (millions)

Build large (probability = 0.5)

facility $50

(no test)

B Reservoir is small

(probability = 0.5)

$10

Reservoir is large

Build small (probability = 0.5)

facility $30

(no test)

A C Reservoir is small

(probability = 0.5)

$20

Payoff

Build large facility (millions)

Test says reservoir is large

$50

(probability = 0.5)

E Build small facility

Conduct seismic $30

test first

D

Test says reservoir is small Build large facility

(probability = 0.5) $10

F Build small facility

$20

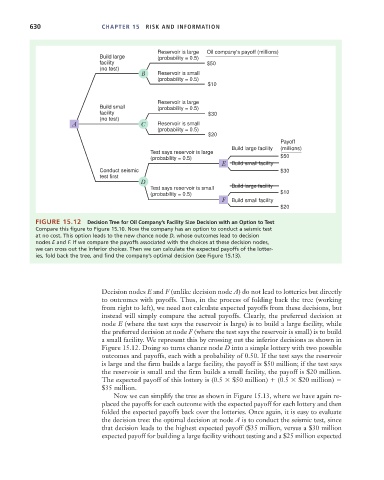

FIGURE 15.12 Decision Tree for Oil Company’s Facility Size Decision with an Option to Test

Compare this figure to Figure 15.10. Now the company has an option to conduct a seismic test

at no cost. This option leads to the new chance node D, whose outcomes lead to decision

nodes E and F. If we compare the payoffs associated with the choices at these decision nodes,

we can cross out the inferior choices. Then we can calculate the expected payoffs of the lotter-

ies, fold back the tree, and find the company’s optimal decision (see Figure 15.13).

Decision nodes E and F (unlike decision node A) do not lead to lotteries but directly

to outcomes with payoffs. Thus, in the process of folding back the tree (working

from right to left), we need not calculate expected payoffs from these decisions, but

instead will simply compare the actual payoffs. Clearly, the preferred decision at

node E (where the test says the reservoir is large) is to build a large facility, while

the preferred decision at node F (where the test says the reservoir is small) is to build

a small facility. We represent this by crossing out the inferior decisions as shown in

Figure 15.12. Doing so turns chance node D into a simple lottery with two possible

outcomes and payoffs, each with a probability of 0.50. If the test says the reservoir

is large and the firm builds a large facility, the payoff is $50 million; if the test says

the reservoir is small and the firm builds a small facility, the payoff is $20 million.

The expected payoff of this lottery is (0.5 $50 million) (0.5 $20 million)

$35 million.

Now we can simplify the tree as shown in Figure 15.13, where we have again re-

placed the payoffs for each outcome with the expected payoff for each lottery and then

folded the expected payoffs back over the lotteries. Once again, it is easy to evaluate

the decision tree: the optimal decision at node A is to conduct the seismic test, since

that decision leads to the highest expected payoff ($35 million, versus a $30 million

expected payoff for building a large facility without testing and a $25 million expected