Page 37 - CCFA Journal - 11th Issue

P. 37

加中金融 金融监管 Regulation

2.1 Interest rate risk and liquidity risk management and IRRBB and stress testing

SVB’s default can be linked directly to the failure of managing the liquidity and interest-rate risk. “SVB struggled to ride a high

interest rate environment in the months leading up to its collapse, with deposit costs outpacing fattening interest revenues.

Interest expenses rose at an average rate of 164% between Q2 and Q4 2022, for a cumulative 1,698% increase over the year, to

$719 million. Growth in interest income was slug-like in comparison, averaging 16% every quarter, for a 57% increase to $1.8

billion over the same period.” [5]

As a key measure to manage interest rate risk in the banking book, SVB had been disclosing EVE before 2021 but chose not to do

so in 2022. In its last 2021 annual report, the bank reported a decline in its EVE of 27.7% should rates increase by 200bp,

equivalent to 35.3% of its Tier 1 capital.

Reported by Washington Post [6], “SVB’s new projections took effect last year and assumed that cash flow from deposits would

stay consistent for longer, softening the projected bite of higher interest rates. Before changing the model, an interest-rate hike of

two percentage points would drop a measure of future cash flows by more than 27 percent; afterward, the hit was less than 5

percent, according to the bank’s securities filings.”

“Pushing for the change in assumptions was Dan Beck, SVB’s chief financial officer, according to one former employee, and it was

approved by the bank’s Asset Liability Management Committee, which manages interest-rate risk, both former employees said.

The change made several mid-level bank officials uncomfortable, one person said, though there was historical data on deposits to

support it.”

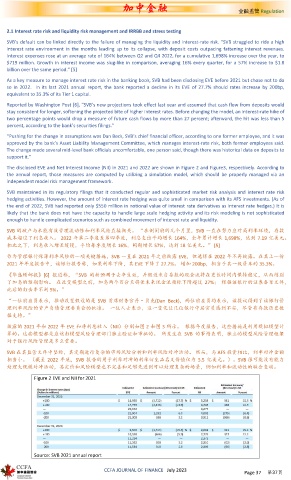

The disclosed EVE and Net Interest Income (NII) in 2021 and 2022 are shown in Figure 2 and Figure3, respectively. According to

the annual report, those measures are computed by utilizing a simulation model, which should be properly managed via an

independent model risk management framework.

SVB maintained in its regulatory filings that it conducted regular and sophisticated market risk analysis and interest rate risk

hedging activities. However, the amount of interest rate hedging was quite small in comparison with its AFS investments. (As of

the end of 2022, SVB had reported only $550 million in notional value of interest rate derivatives as interest rate hedges.) It is

likely that the bank does not have the capacity to handle large scale hedging activity and its risk modeling is not sophisticated

enough to handle complicated scenarios such as combined movement of interest rate and liquidity.

SVB 的破产与未能有效管理流动性和利率风险直接相关。 “在倒闭前的几个月里,SVB 一直在努力应对高利率环境,存款

成本超过了利息收入。 2022 年第二季度至第四季度,利息支出平均增长 164%,全年累计增长 1,698%,达到 7.19 亿美元。

相比之下,利息收入增长缓慢,平均每季度增长 16%,同期增长 57%,达到 18 亿美元。” [5]

作为管理银行账簿利率风险的一项关键措施,SVB 一直在 2021 年之前披露 EVE,但选择在 2022 年不再披露。在其上一份

2021 年年度报告中,该银行报告称,如果利率下降,其 EVE 下降了 27.7%。 增加 200bp,相当于其一级资本的 35.3%。

《华盛顿邮报》[6] 报道称,“SVB 的新预测于去年生效,并假设来自存款的现金流将在更长时间内保持稳定,从而削弱

了加息的预期影响。 在改变模型之前,加息两个百分点将使未来现金流指标下降超过 27%; 根据该银行的证券备案文件,

此后的打击率不到 5%。”

“一位前雇员表示,推动改变假设的是 SVB 首席财务官丹·贝克(Dan Beck),两位前雇员均表示,该提议得到了该银行管

理利率风险的资产负债管理委员会的批准。 一位人士表示,这一变化让几位银行中层官员感到不安,尽管有存款历史数

据支持。”

披露的 2021 年和 2022 年 EVE 和净利息收入(NII)分别如图 2 和图 3 所示。 根据年度报告,这些措施是利用模拟模型计

算的。这些模型都是应该由模型风险管理部门独立验证和审批的。 所发生在 SVB 的事情表明,独立的模型风险管理框架

对于银行风险管理是多么重要。

SVB 在其监管文件中坚称,其定期进行复杂的市场风险分析和利率风险对冲活动。 然而,与 AFS 投资相比,利率对冲金额

相当小。 (截至 2022 年底,SVB 报告的用于利率对冲的利率衍生品名义价值仅为 5.5 亿美元。)。SVB 很可能没有能力

处理大规模对冲活动,其定价和风险模型也不完善和足够先进到可以处理复杂的场景,例如利率和流动性的联合变动。

Figure 2 EVE and NII for 2021

Source: SVB 2021 annual report

CCFA JOURNAL OF FINANCE July 2023 Page 37 第37页