Page 38 - CCFA Journal - 11th Issue

P. 38

金融监管 Regulation 加中金融

Figure 3 NII for 2022

Source SVB 2022 annua report

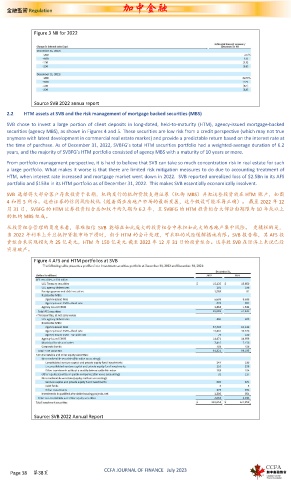

2.2 HTM assets at SVB and the risk management of mortgage backed securities (MBS)

SVB chose to invest a large portion of client deposits in long-dated, held-to-maturity (HTM), agency-issued mortgage-backed

securities (agency MBS), as shown in Figures 4 and 5. These securities are low risk from a credit perspective (which may not true

anymore with latest development in commercial real estate market) and provide a predictable return based on the interest rate at

the time of purchase. As of December 31, 2022, SVBFG’s total HTM securities portfolio had a weighted-average duration of 6.2

years, and the majority of SVBFG’s HTM portfolio consisted of agency MBS with a maturity of 10 years or more.

From portfolio management perspective, it is hard to believe that SVB can take so much concentration risk in real estate for such

a large portfolio. What makes it worse is that there are limited risk mitigation measures to do due to accounting treatment of

HTM, when interest rate increased and mortgage market went down in 2022. SVB reported unrealized loss of $2.5Bn in its AFS

portfolio and $15Bn in its HTM portfolio as of December 31, 2022. This makes SVB essentially economically insolvent.

SVB 选择将大部分客户存款投资于长期,机构发行的抵押贷款支持证券(机构 MBS)并把这些投资放在 HTM 账户,如图

4 和图 5 所示。这些证券的信用风险较低(随着商业房地产市场的最新发展,这个假设可能不再正确)。 截至 2022 年 12

月 31 日,SVBFG 的 HTM 证券投资组合总加权平均久期为 6.2 年,且 SVBFG 的 HTM 投资组合大部分由期限为 10 年或以上

的机构 MBS 组成。

从投资组合管理的角度来看,很难相信 SVB 能够在如此庞大的投资组合中承担如此大的房地产集中风险。 更糟糕的是,

当 2022 年利率上升且抵押贷款市场下滑时,由于 HTM 的会计处理,可采取的风险缓解措施有限。SVB 报告称,其 AFS 投

资组合未实现损失为 25 亿美元,HTM 为 150 亿美元 截至 2022 年 12 月 31 日的投资组合。这导致 SVB 在经济上来说已经

实质破产。

Figure 4 AFS and HTM portfolios at SVB

Source: SVB 2022 Annual Report

CCFA JOURNAL OF FINANCE July 2023

Page 38 第38页