Page 40 - CCFA Journal - 11th Issue

P. 40

金融监管 Regulation 加中金融

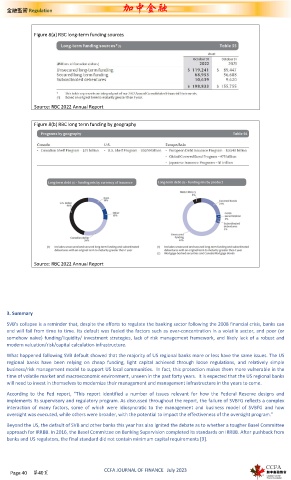

Figure 8(a) RBC long-term funding sources

Source: RBC 2022 Annual Report

Figure 8(b) RBC long term funding by geography

Source: RBC 2022 Annual Report

3. Summary

SVB’s collapse is a reminder that, despite the efforts to regulate the banking sector following the 2008 financial crisis, banks can

and will fail from time to time. Its default was fueled the factors such as over-concentration in a volatile sector, and poor (or

somehow naïve) funding/liquidity/ investment strategies, lack of risk management framework, and likely lack of a robust and

modern valuation/risk/capital calculation infrastructure.

What happened following SVB default showed that the majority of US regional banks more or less have the same issues. The US

regional banks have been relying on cheap funding, light capital achieved through loose regulations, and relatively simple

business/risk management model to support US local communities. In fact, this protection makes them more vulnerable in the

time of volatile market and macroeconomic environment, unseen in the past forty years. It is expected that the US regional banks

will need to invest in themselves to modernize their management and management infrastructure in the years to come.

According to the Fed report, “This report identified a number of issues relevant for how the Federal Reserve designs and

implements its supervisory and regulatory program. As discussed throughout the report, the failure of SVBFG reflects a complex

interaction of many factors, some of which were idiosyncratic to the management and business model of SVBFG and how

oversight was executed, while others were broader, with the potential to impact the effectiveness of the oversight program.”

Beyond the US, the default of SVB and other banks this year has also ignited the debate as to whether a tougher Basel Committee

approach for IRRBB. In 2016, the Basel Committee on Banking Supervision completed its standards on IRRBB. After pushback from

banks and US regulators, the final standard did not contain minimum capital requirements [9].

CCFA JOURNAL OF FINANCE July 2023

Page 40 第40页