Page 39 - CCFA Journal - 11th Issue

P. 39

加中金融 金融监管 Regulation

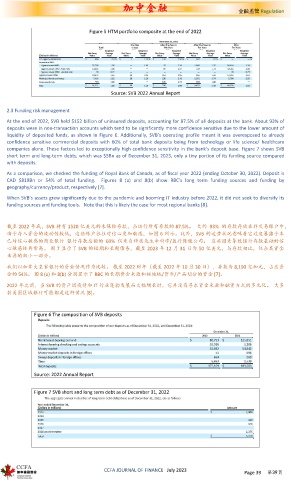

Figure 5 HTM portfolio composite at the end of 2022

Source: SVB 2022 Annual Report

2.3 Funding risk management

At the end of 2022, SVB held $152 billion of uninsured deposits, accounting for 87.5% of all deposits at the bank. About 93% of

deposits were in non-transaction accounts which tend to be significantly more confidence sensitive due to the lower amount of

liquidity of deposited funds, as shown in Figure 6. Additionally, SVB’s operating profile meant it was overexposed to already

confidence sensitive commercial deposits with 60% of total bank deposits being from technology or life science/ healthcare

companies alone. These factors led to exceptionally high confidence sensitivity in the bank’s deposit base. Figure 7 shows SVB

short term and long-term debts, which was $5Bn as of December 31, 2023, only a tiny portion of its funding source compared

with deposits.

As a comparison, we checked the funding of Royal Bank of Canada, as of fiscal year 2022 (ending October 30, 2022). Deposit is

CAD $819Bn or 54% of total funding. Figures 8 (a) and 8(b) show RBC’s long term funding sources and funding by

geography/currency/product, respectively [7].

When SVB’s assets grew significantly due to the pandemic and booming IT industry before 2022, it did not seek to diversify its

funding sources and funding tools. Note that this is likely the case for most regional banks [8].

截至 2022 年底,SVB 持有 1520 亿美元的未保险存款,占该行所有存款的 87.5%。 大约 93% 的存款存放在非交易账户中,

由于存入资金的流动性较低,这些账户往往对信心更加敏感,如图 6 所示。此外,SVB 的运营状况意味着它过度暴露于本

已对信心敏感的商业银行 银行存款总额的 60% 仅来自科技或生命科学/医疗保健公司。 这些因素导致银行存款基础的信

心敏感性异常高。 图 7 显示了 SVB 的短期和长期债务,截至 2023 年 12 月 31 日为 50 亿美元,与存款相比,仅占其资金

来源的极小一部分。

我们以加拿大皇家银行的资金情况作为比较。 截至 2022 财年(截至 2022 年 10 月 30 日),存款为 8,190 亿加元,占总资

金的 54%。 图 8 (a) 和 8(b) 分别显示了 RBC 的长期资金来源和按地域/货币/产品划分的资金 [7]。

2022 年之前,当 SVB 的资产因疫情和 IT 行业蓬勃发展而大幅增长时,它并没有寻求资金来源和融资方式的多元化。 大多

数美国区域银行可能都是这种情况 [8]。

Figure 6 The composition of SVB deposits

Source: 2022 Annual Report

Figure 7 SVB short and long term debt as of December 31, 2022

CCFA JOURNAL OF FINANCE July 2023 Page 39 第39页