Page 37 - CCFA Journal - Ninth Issue

P. 37

加中金融 数学建模 Math Modeling

加中金融

2 The Merton Model

In 1974, Merton proposed a model where a company’s equity is an option on the assets of the company. Assuming a simple capital

structure of a firm is:

2 Merton 模型

Merton(1974)提出的模型中,公司股权被看作公司资产的期权。假设一个公司的简单资本结构是:

A = Equities + Liabilities = S + B [1]

The firm is limited liability firm. Assume that at time T, the firm (equity) will be faced with a payment obligation of D. If the firm’s

value is less than the payment obligation, equity will declare bankrupt of the firm. The key assumption of the Merton model is that

both equity and debt can be viewed as derivative securities on the value A, with the following payoff

本公司为有限责任公司。假设在 T 时刻,企业(股权)将面临 D 的支付义务,如果企业价值小于支付义务,股权将宣告企

业破产。 Merton 模型的关键假设是股票和债务都可以看作是价值 A 的衍生证券,具有以下收益

( , ) = ( , ); ( , ) = max ( − , 0) [2]

The value of assets A is assumed to follow a log-normal diffusion process that is under the physical probability measure:

假定资产 A 的价值遵循物理概率测度下的对数正态扩散过程:

dA = μAdt + σAdW(t) [3]

where W(t) is the standard Brownian motion, μ is the instantaneous expected return on assets, σ is the constant proportional

volatility of the return on the firm value. Following the standard Black-Scholes-Merton pricing theory, we can solve it via an PDE

approach. The firm defaults if A<D. The PD of the firm can be computed as:

其中 W(t) 是标准布朗运动, μ 是资产的瞬时预期回报率,σ 是公司价值回报率的恒定比例波动率。遵循标准的 Black-

Scholes-Merton 定价理论,我们可以通过 PDE 方法解决它。如果 A<D,公司违约。公司的违约概率可以计算为:

( . )( ))

( ) = ( ( ) < ) = ( ) [4]

√

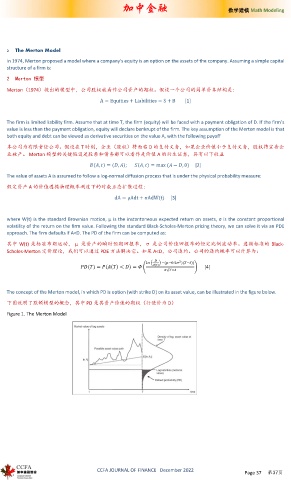

The concept of the Merton model, in which PD is option (with strike D) on its asset value, can be illustrated in the figure below.

下图说明了默顿模型的概念,其中 PD 是其资产价值的期权(行使价为 D)

Figure 1. The Merton Model

CCFA JOURNAL OF FINANCE December 2022

Page 37 第37页