Page 35 - CCFA Journal - Ninth Issue

P. 35

加中金融 风险管理 Risk Management

加中金融

Challenges of Stress Testing and Credit Provisioning 新冠期间压力测试和信用风险拨备的挑战

during the pandemic

压力测试和 ECL 模型的输入参数为宏观经济和金融指标

Both stress testing and ECL models rely on macroeconomic

and financial variables as inputs, with the parameters 变量,这些变量是根据长达 20 年的历史数据校准的而来。

calibrated to historical data going back as far as 20 years. In 2020 年第一季度,Covid-19 大流行导致短期内大量企业关

Q1 2020, due to the Covid-19 pandemic, businesses were shut 闭,数百万人失业,宏观经济出现前所未有的恶化,当

down and millions of jobs were lost almost overnight followed 时预计 GDP 可能下降 30%,失业率可能高达 50%。为应

by massive fiscal stimulus from governments. The projected 对新冠疫情的冲击,各国政府相继出台了大规模财政刺

GDP from the model could be down by up to 30% and the 激措施。基于这些场景和历史数据校准的参数,所有债

projected unemployment rate could go up to 50%, which have 务人基本上都会违约,并导致巨大损失。为应对新冠肺

never happened before. Based on these scenarios and 炎而采取的措施打破了任何基于大流行前数据建立的模

calibrated parameters via historical data, all obligors would 型范畴。

essentially default, leading to huge losses. The stimulus and

other stability measures in response to challenges posed by 因此,银行通过更换模型和显著提升信用风险拨备计提

Covid-19 break the boundaries of any model that was built 的方式来应对此变化。2020 年第二季度,加拿大皇家银

based on pre-pandemic data. 行的 PCL 为 28 亿加元(第一季度为 4 亿加元), TD 为 32 亿

加元(第一季度为 9亿加元),丰业银行为 18亿加元(第一季

Nevertheless, the banks had to change the model and post a 度为 9.36 亿加元),加拿大帝国商业银行为 14 亿加元(第一

significant increase in PCLs. In Q2 2020, RBC recorded a PCL of 季度为 2.61 亿加元),蒙特利尔银行为 11 亿加元(第一季度

2.8Bn (vs. 400MM in Q1), TD 3.2Bn (vs. 900MM in Q1), Scotia 为 1.76 亿加元)。

Bank 1.8Bn (vs. 936MM), CIBC 1.4Bn (vs. 261MM in Q1), BMO

1.1Bn (vs. 176MM in Q1). 事实证明,银行高估了 PCL。由于基于行业/评级的预期

Looking back from today, the new credit models PD 和 LGD,新的信贷模型未能考虑到政府支持措施,并

overestimated the PCL levels significantly, by failing to take 高估了财务状况良好的公司的损失,即使是在陷入困境

into account of government support measures, even for 的行业。

companies that were financially strong just because they were 随着一些主要经济体反弹,PCL 在 2021 年期间被下调,

in troubled sectors, as the stressed PD and LGD were 但这一做法存在争议。因考虑到大流行的情况,相同的

projected by both sector and rating.

压力模型将预测过低的 PD。进入 2021 年,压力测试和

The PCL were revised down over the course of 2021, as some ECL 模型面临高通胀和高利率的新挑战,这些都在历史

major economies bounced back. However, it is debatable, 数据校准窗口之外。从 2019 年至 2020 年,RBC 季度 PCL

because the same stress model would predict a too low PD, 如图 4 所示,反映了不断变化的宏观经济环境和信贷模型

with pandemic scenarios were taken into account. Entering 表现的挑战。

2021, the stress testing and ECL model have new challenges

of high inflation and high interest rates, which are all absent 在 2022 年第四季度,由于银行考虑到更悲观的宏观经济

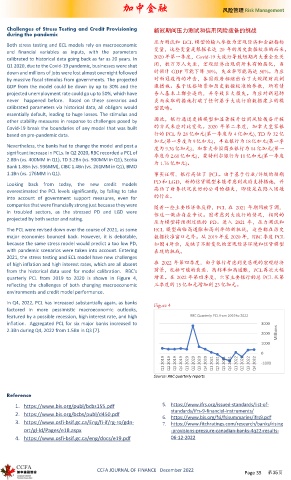

from the historical data used for model calibration. RBC’s 前景,包括可能的衰退、高利率和高通胀,PCL再次大幅

quarterly PCL from 2019 to 2020 is shown in Figure 4, 增长。在 2022 年第四季度,六家主要银行的总 PCL 从第

reflecting the challenges of both changing macroeconomic 三季度的 15 亿加元增加到 23 亿加元。

environments and credit model performance.

In Q4, 2022, PCL has increased substantially again, as banks Figure 4

factored in more pessimistic macroeconomic outlooks,

featured by a possible recession, high interest rate, and high RBC Quarterly PCL from 2019 to 2022

inflation. Aggregated PCL for six major banks increased to 3000

2.3Bn during Q4, 2022 from 1.5Bn in Q3 [7].

2000 Millions

1000

0

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 -1000

Source: RBC quarterly reports

Reference

1. https://www.bis.org/publ/bcbs155.pdf 5. https://www.ifrs.org/issued-standards/list-of-

standards/ifrs-9-financial-instruments/

2. https://www.bis.org/bcbs/publ/d450.pdf 6. https://www.bis.org/fsi/fsisummaries/ifrs9.pdf

3. https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn- 7. https://www.fitchratings.com/research/banks/rising

ort/gl-ld/Pages/e18.aspx -provisions-pressure-canadian-banks-4q22-results-

4. https://www.osfi-bsif.gc.ca/eng/docs/e19.pdf 06-12-2022

CCFA JOURNAL OF FINANCE December 2022

Page 35 第35页