Page 39 - CCFA Journal - Ninth Issue

P. 39

加中金融 数学建模 Math Modeling

加中金融

3.2 PD projection models

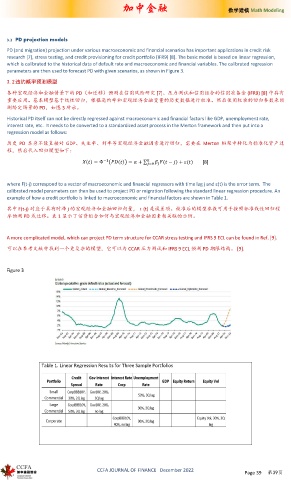

PD (and migration) projection under various macroeconomic and financial scenarios has important applications in credit risk

research [7], stress testing, and credit provisioning for credit portfolio (IFR9) [8]. The basic model is based on linear regression,

which is calibrated to the historical data of default rate and macroeconomic and financial variables. The calibrated regression

parameters are then used to forecast PD with given scenarios, as shown in Figure 3.

3.2 违约概率预测模型

各种宏观经济和金融情景下的 PD(和迁移)预测在信用风险研究 [7]、压力测试和信用组合的信用准备金 (IFR9) [8] 中具有

重要应用。基本模型基于线性回归,根据违约率和宏观经济金融变量的历史数据进行校准。然后使用校准的回归参数来预

测给定场景的 PD,如图 3 所示。

Historical PD itself can not be directly regressed against macroeconomic and financial factors like GDP, unemployment rate,

interest rate, etc. It needs to be converted to a standardized asset process in the Merton framework and then put into a

regression model as follows:

历史 PD 本身不能直接对 GDP、失业率、利率等宏观经济金融因素进行回归,需要在 Merton 框架中转化为标准化资产过

程,然后代入回归模型如下:

( ) = Φ ( ) = + ∑ ( − ) + ( ) [8]

where F(t-j) correspond to a vector of macroeconomic and financial regressors with time lag j and ε(t) is the error term. The

calibrated model parameters can then be used to project PD or migration following the standard linear regression procedure. An

example of how a credit portfolio is linked to macroeconomic and financial factors are shown in Table 1.

其中 F(t-j) 对应于具有时滞 j 的宏观经济和金融回归向量,ε(t) 是误差项。校准后的模型参数可用于按照标准线性回归程

序预测 PD 或迁移。表 1 显示了信贷组合如何与宏观经济和金融因素相关联的示例。

A more complicated model, which can project PD term structure for CCAR stress testing and IFRS 9 ECL can be found in Ref. [9].

可以在参考文献中找到一个更复杂的模型,它可以为 CCAR 压力测试和 IFRS 9 ECL 预测 PD 期限结构。 [9].

Figure 3

Table 1. Linear Regression Results for Three Sample Portfolios

CCFA JOURNAL OF FINANCE December 2022

Page 39 第39页