Page 31 - CCFA Journal - Fourth Issue

P. 31

加中金融 Quant Corner 数量分析

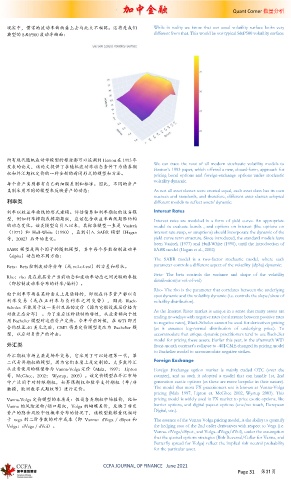

现实中,惯常的波动率曲面看上去与此大不相同。这将是我们 While in reality we know that our usual volatility surface looks very

典型的 S&P500 波动率曲面: different from that. This would be our typical S&P500 volatility surface:

所有现代随机波动率模型的根源都可以追溯到 Heston 在 1993年 We can trace the root of all modern stochastic volatility models to

发表的论文,该论文提供了在随机波动率动态条件下为债券期 Heston’s 1993 paper, which offered a new, closed-form, approach for

权和外汇期权定价的一种全新的封闭形式的模型和方法。 pricing bond options and foreign-exchange options under stochastic

volatility dynamic.

每个资产类别都有自己的细微差别和标准。因此,不同的资产

类别采用不同的模型来反映资产的动态: As not all asset classes were created equal, each asset class has its own

nuances and standards, and therefore, different asset classes adopted

利率类 different models to reflect assets’ dynamic:

利率以收益率曲线的形式建模。评估债券和利率期权的适当模 Interest Rates

型,例如利率掉期或掉期期权,应该包含收益率曲线期限结构 Interest rates are modeled in a form of yield curve. An appropriate

的动态变化。该类模型自引入以来,其标准模型一直是 Vasicek model to evaluate bonds , and options on interest (like options on

(1977)和 Hull-White(1990),直到引入 SABR 模型(Hagan interest rate swap, or swaptions) should incorporate the dynamic of the

等,2002)后开始变化。 yield curve term structure. Since introduced, the standard models have

been Vasicek (1977) and Hull-White (1990), until the introduction of

SABR 模型是两个因子的随机模型,其中每个参数控制波动率 SABR model (Hagan et al., 2002)

(alpha)动态的不同方面:

The SABR model is a two-factor stochastic model, where each

Beta:Beta 控制波动率分布(或 vol-of-vol)的方差和形状。 parameter controls a different aspect of the volatility (alpha) dynamic:

Beta- The beta controls the variance and shape of the volatility

Rho:rho 是在底层资产当前动态和波动率动态之间关联的参数 distribution(or vol-of-vol)

(即控制波动率分布的斜率/偏斜)。

Rho- The rho is the parameter that correlates between the underlying

由于利率市场在某种意义上是独特的,即现在许多资产都以负 spot dynamic and the volatility dynamic (i.e. controls the slope/skew of

利率交易(或在正利率与负利率之间交替),因此 Black- volatility distribution).

Scholes 不能用于这一类衍生品的定价(因为它假设底层价格为

对数正态分布) 。为了适应这种独特的特性,从业者倾向于使 As the Interest Rates market is unique in a sense that many assets are

trading nowadays with negative rates (or alternate between positive rates

用 Bachelier 模型对这些资产定价。今年早些时候,在 WTI 即月 to negative rates), Black-Scholes cannot be used for derivatives pricing

合约跌至-40 美元之后,CME 将其定价模型更改为 Bachelier 模 (as it assumes log-normal distribution of underlying price). To

型,以应对负资产的冲击。 accommodate that unique dynamic practitioners tend to use Bachelier

model for pricing these assets. Earlier this year, in the aftermath WTI

外汇类 front-month contract’s collapse to -40$ CME changed its pricing model

to Bachelier model to accommodate negative strikes.

外汇期权市场主要是场外交易,它采用了可以处理第一代,第

二代奇异期权的模型,因为它们本质上是定制的。大多数外汇 Foreign Exchange

从业者使用的模型称为 Vanna-Volga 定价(Malz,1997; Lipton Foreign Exchange option market is mainly traded OTC (over the

等,McGhee,2002; Wystup,2003)。该定价模型在外汇市场 counter), and as such it adopted a model that can handle 1st, 2nd

中广泛用于对特殊期权,如界限期权和数字支付期权(单/非 generation exotic options (as these are more bespoke in their nature).

触摸,欧洲数字式期权等)进行定价。 The model that most FX practitioners use is known as Vanna-Volga

pricing (Malz 1997, Lipton et. McGhee 2002, Wystup 2003). This

Vanna-Volga 定价模型的本质是:假设各类期权市场报价,比如 pricing model is widely used in FX market to price exotic options, like

Vanna 的风险逆转/领口期权,Volga 的蝴蝶差价,反映了特定 barrier options, and digital payout options (one/no touch, European

Digital, etc.).

资产的隐含风险中性概率分布的情况下,该模型能够量化相对

于 vega 的二阶导数的对冲成本(即 Vanna:dVega / dSpot 和 The essence of the Vanna-Volga pricing model, is the ability to quantify

Volga:dVega / dVol)。 the hedging cost of the 2nd order derivatives with respect to Vega (i.e.

Vanna- dVega/dSpot , and Volga- dVega/dVol), under the assumption

that the quoted options strategies (Risk Reversal/Collar for Vanna, and

Butterfly spread for Volga) reflect the implied risk neutral probability

for the particular asset.

CCFA JOURNAL OF FINANCE June 2021

Page 31 第31页