Page 9 - CCFA Journal - Seventh Issue

P. 9

加中金融 地缘热点 Geo Hotspots

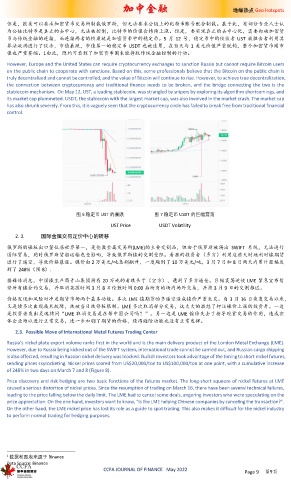

但是,欧美可以要求加密货币交易所制裁俄罗斯,但无法要求公链上的比特币账号配合制裁。基于此,有部分专业人士认

为公链比特币是真正的去中心,无法被控制,比特币的价值会持续上涨。但是,要实现真正的去中心化,需要打破加密货

币与传统金融的连接,而连接两者的桥梁就是加密货币中的稳定币。5 月 12 号,稳定币中的佼佼者 UST 被狙击者利用其

算法漩涡进行了绞杀,市值暴跌,市值第一的稳定币 USDT 也被连累,在当天与 1 美元价值严重脱钩,整个加密货币圈市

值也严重萎缩。1由此,隐约可看到了加密货币圈未能挣脱传统金融控制的行动。

However, Europe and the United States can require cryptocurrency exchanges to sanction Russia but cannot require Bitcoin users

on the public chain to cooperate with sanctions. Based on this, some professionals believe that the Bitcoin on the public chain is

truly decentralized and cannot be controlled, and the value of Bitcoin will continue to rise. However, to achieve true decentralization,

the connection between cryptocurrency and traditional finance needs to be broken, and the bridge connecting the two is the

stablecoin mechanism. On May 12, UST, a leading stablecoin, was strangled by snipers by exploring its algorithm shortcomings, and

its market cap plummeted. USDT, the stablecoin with the largest market cap, was also involved in the market crash. The market cap

has also shrunk severely. From this, it is vaguely seen that the cryptocurrency circle has failed to break free from traditional financial

control.

图 6 稳定币 UST 的暴跌 图 7 稳定币 USDT 的巨幅震荡

UST Price USDT Volatility

2.3. 国际金属交易定价中心的转移

俄罗斯的镍板出口量位居世界第一,是伦敦金属交易所(LME)的主要交割品,但由于俄罗斯被踢出 SWIFT 系统,无法进行

国际贸易,同时俄罗斯货船运输也受影响,导致俄罗斯镍的交割受阻。看涨的投资者(多方)利用这些天时地利对镍期货

进行了逼空,导致价格暴涨。镍价由 2 万美元/吨急剧飙升,一度飚到了 10 万美元/吨,3 月 7 日和 8 日两天内累计涨幅达

到了 248%(图 8).

据媒体消息,中国镍生产商青山集团持有 20 万吨的看跌头寸(空方),遭到了多方逼仓。巨幅震荡迫使 LME 紧急宣布暂

停所有镍合约交易,并取消英国时间 3 月 8 日伦敦时间 0:00 后所有的场内场外交易,并将 3 月 9 日的交割推迟。

价格发现和风险对冲是期货市场两个基本功能。本次 LME 镍期货的多逼空造成镍价严重失灵。自 3 月 16 日恢复交易以来,

又连续多次出现技术故障,跌破当日跌停板限制。LME 多次取消部分交易,这大大的激怒了押注镍价上涨的投资者。一边

是投资者发出灵魂拷问“LME 取消交易是在帮中国公司吗?”。另一边是 LME 镍价失去了指导现货交易的作用,造成实

体企业难以进行正常交易,进一步加剧了期货的价格,使得避险功能也没有正常发挥。

2.3. Possible Move of International Metal Futures Trading Center

Russia's nickel plate export volume ranks first in the world and is the main delivery product of the London Metal Exchange (LME).

However, due to Russia being kicked out of the SWIFT system, international trade cannot be carried out, and Russian cargo shipping

is also affected, resulting in Russian nickel delivery was blocked. Bullish investors took advantage of the timing to short nickel futures,

sending prices skyrocketing. Nickel prices soared from US$20,000/ton to US$100,000/ton at one point, with a cumulative increase

of 248% in two days on March 7 and 8 (Figure 8).

Price discovery and risk hedging are two basic functions of the futures market. The long-short squeeze of nickel futures at LME

caused a serious distortion of nickel prices. Since the resumption of trading on March 16, there have been several technical failures,

leading to the price falling below the daily limit. The LME had to cancel some deals, angering investors who were speculating on the

price appreciation. On the one hand, investors want to know, "Is the LME helping Chinese companies by canceling the transaction?".

On the other hand, the LME nickel price has lost its role as a guide to spot trading. This also makes it difficult for the nickel industry

to perform normal trading for hedging purposes.

1 数据和图表来源于 Binance

Data Source: Binance

CCFA JOURNAL OF FINANCE May 2022

Page 9 第9页