Page 33 - CCFAJournal-FirstIssue

P. 33

加中金融

美国基金业发展的启示 The Enlightenment of American Fund

Management Industry Development

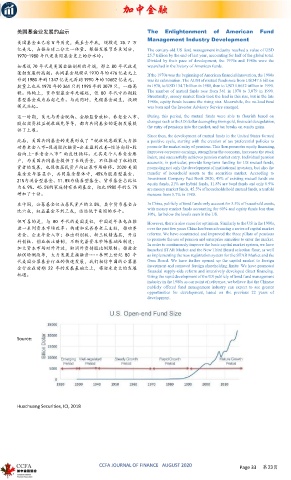

美国基金业已有百年历史,截至去年底,规模达 25.7 万

亿美元,占据全球二分之一体量。根据发展节奏来划分, The century-old US fund management industry reached a value of USD

1970-1980 年代是美国基金史上的分水岭。 25.7 trillion by the end of last year, accounting for half of the global total.

Divided by their pace of development, the 1970s and 1980s were the

如果说 70 年代是美国金融创新的开端,那么 80 年代就是 watershed in the history of American funds.

蓬勃发展的高潮。共同基金规模从 1970 年的 476 亿美元上 If the 1970s was the beginning of American financial innovation, the 1980s

升到 1980 年的 1347 亿美元再到 1990 年的 10652 亿美元, was its culmination. The AUM of mutual funds rose from USD47.6 billion

数量上也从 1970 年的 361 只到 1990 年的 3079 只,一路高 in 1970, to USD 134.7 billion in 1980, then to USD 1.0652 trillion in 1990.

歌。结构上,货币型基金率先崛起,但 80 年代中后期股 The number of mutual funds rose from 361 in 1970 to 3,079 in 1990.

Structurally, money market funds took the lead in this rise, but in the late

票型基金成为后起之秀。与此同时,免佣基金诞生,投顾 1980s, equity funds became the rising star. Meanwhile, the no-load fund

模式兴起。 was born and the Investor Advisory Service emerged.

这一时期,美元与黄金脱钩、金融监管放松、养老金入市、 During this period, the mutual funds were able to flourish based on

股权投资收益税收减免等等,都为共同基金的蓬勃发展提 changes such as the US dollar decoupling from gold, financial deregulation,

the entry of pensions into the market, and tax breaks on equity gains.

供了土壤。

Since then, the development of mutual funds in the United States formed

此后,美国共同基金的发展形成了“税收优惠政策大力推 a positive cycle, starting with the creation of tax preferential policies to

动养老金入市-促进股权融资-企业盈利改善-经济向好-股 promote the market entry of pensions. This then promotes equity financing,

指向上-养老金入市”的良性循环。尤其是个人养老金账 improves corporate earnings, strengthens the economy, increases the stock

index, and successfully achieves pension market entry. Individual pension

户,为美国共同基金提供了长线资金,不仅推动了机构投 accounts, in particular, provide long-term funding for US mutual funds,

资者的发展,也促使居民资产向证券市场转移。2020 美国 promoting not only the development of institutional investors, but also the

基金业年鉴显示,共同基金整体中,45%为股票型基金、 transfer of household assets to the securities market. According to

21%为混合型基金、11.8%为债券型基金、货币基金占比仅 Investment Company Fact Book 2020, 45% of existing mutual funds are

equity funds, 21% are hybrid funds, 11.8% are bond funds and only 6.9%

为 6.9%。45.5%的家庭持有共同基金,相比 1980 年的 5.7% are money market funds. 45.5% of households hold mutual funds, a tenfold

增加了十倍。 increase from 5.7% in 1980.

在中国,公募基金仅占居民资产的 3.5%,其中货币基金占 In China, publicly offered funds only account for 3.5% of household assets,

比六成,权益基金不到三成,远远低于美国的水平。 with money market funds accounting for 60% and equity funds less than

30%, far below the levels seen in the US.

但可喜的是,与 80 年代的美国类似,中国近年来也在推 However, there is also cause for optimism. Similarly to the US in the 1980s,

进一系列资本市场改革:构建和完善养老三支柱,推动养 over the past few years China has been advancing a series of capital market

老金、企业年金入市;推出科创板、新三板精选层,开启 reforms. We have constructed and improved the three pillars of pensions

科创板、创业板注册制,不断完善资本市场基础性制度; to promote the use of pension and enterprise annuities to enter the market.

In order to continuously improve the basic capital market system, we have

加大资本市场对外开放,取消外资持股比例限制;推进金 launched STAR Market and the New Third Board selection floor, as well

融供给侧改革,大力发展直接融资……参照上世纪 80 年 as implementing the new registration system for the STAR Market and the

代美国公募基金行业的快速发展,我们相信中国的公募基 Gem Board. We have further opened up the capital market to foreign

金行业在前期 22 年的发展基础之上,将迎来更大的发展 investment and removed foreign shareholding limits. We have promoted

financial supply-side reform and intensively developed direct financing.

机遇。 Using the rapid development of the US publicly offered fund management

industry in the 1980s as our point of reference, we believe that the Chinese

publicly offered fund management industry can expect to see greater

opportunities for development, based on the previous 22 years of

development.

Source:

Huachuang Securities, ICI, 2018

CCFA JOURNAL OF FINANCE AUGUST 2020 Page 33 第33页