Page 34 - CCFAJournal-FirstIssue

P. 34

加中金融

中外合资基金公司的现状 Current Status of Chinese-Foreign Joint

Venture Fund Management Companies

美国基金业已有百年历史,截至去年底,规模达 25.7万

亿美元,占据全球二分之一体量。根据发展节奏来划分, Of the 143 institutions in China with publicly offered fund licenses, 43 are

1970-1980 年代是美国基金史上的分水岭。 joint ventures, accounting for nearly a third. As of December 31, 2019, the

assets managed by Chinese-foreign joint venture fund companies totaled

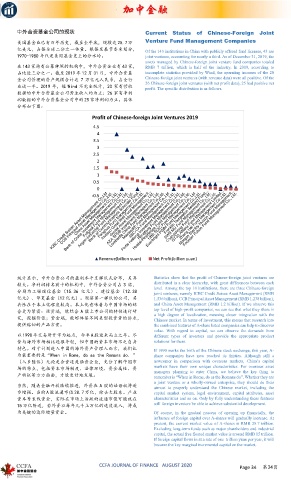

在 143 家持有公募牌照的机构中,中外合资企业有 43 家, RMB 7 trillion, which is half of the industry. In 2019, according to

占比近三分之一。截至 2019 年 12 月 31 日,中外合资基 incomplete statistics provided by Wind, the operating incomes of the 20

金公司管理的资产规模合计达 7 万亿元人民币,占全行 Chinese-foreign joint ventures (with revenue data) were all positive. Of the

业近一半。2019 年,据 Wind 不完全统计,20 家有营收 26 Chinese-foreign joint ventures (with net profit data), 25 had positive net

profit. The specific distribution is as follows.

数据的中外合资基金公司营业收入均为正;26 家有净利

润数据的中外合资基金公司中的 25 家净利润为正。具体

分布如下图:

Profit of Chinese-foreign Joint Ventures 2019

4.5

4

3.5

3

2.5

2

1.5

1

0.5

0

-0.5

Revenue(billion yuan) Net Profit(billion yuan)

统计显示,中外合资公司的盈利水平呈梯队式分布,差异 Statistics show that the profit of Chinese-foreign joint ventures are

较大。净利润排名前十的机构中,中外合资公司占 3 席, distributed in a clear hierarchy, with great differences between each

level. Among the top 10 institutions, there are three Chinese-foreign

分别为工银瑞信基金(15.36 亿元)、建信基金(12.38 joint ventures, namely ICBC Credit Suisse Asset Management (RMB

亿元)、华夏基金(12 亿元)。观察第一梯队的公司,其 1.536 billion), CCB Principal Asset Management (RMB 1.238 billion),

共性在于本土化程度较高。本土化意味着与中国市场的结 and China Asset Management (RMB 1.2 billion). If we observe this

合更为紧密:投资端,能结合 A 股上市公司的特性进行研 top level of high-profit companies, we can see that what they share is

a high degree of localization, meaning closer integration with the

究,挖掘价值;资金端,能够体察不同类型投资者的诉求, Chinese market. In terms of investment, this means that research into

提供贴切的产品方案。 the combined features of A-share listed companies can help to discover

value. With regard to capital, we can observe the demands from

以 1990 年交易所开市为起点,今年 A 股迎来而立之年。尽 different types of investors and provide the appropriate product

管与海外市场相比还很年轻,但中国的资本市场不乏自身 solutions for them.

特色。对于计划进入中国的海外资产管理人而言,我们认 If 1990 marks the birth of the Chinese stock exchange, this year, A-

为最重要的是“When in Rome, do as the Romans do. ” share companies have now reached its thirties. Although still a

(入乡随俗)无论是合资还是独资企业,充分了解中国市 newcomer in comparison with overseas markets, China’s capital

markets have their own unique characteristics. For overseas asset

场的特点,包括资本市场制度、法律环境、资金属性、资

managers planning to enter China, we believe the key thing to

产特征等方方面面,才能更好地发展。 remember is “When in Rome, do as the Romans do”. Whether they are

a joint venture or a wholly-owned enterprise, they should do their

当然,随着金融开放陆续推进,外资在 A 股的话语权将逐 utmost to properly understand the Chinese market, including the

步增强。当前 A 股流通市值 28.7 万亿,除去大股东、产业 capital market system, legal environment, capital attributes, asset

资本等长线资金,实际在市场上活跃的流通市值可能就在 characteristics and so on. Only by fully understanding these features

15 万亿附近,若外资以每年几千上万亿的速度流入,将成 will foreign investors be able to achieve substantial development.

为关键的边际增量资金。 Of course, in the gradual process of opening up financially, the

influence of foreign capital over A-shares will gradually increase. At

present, the current market value of A-shares is RMB 28.7 trillion.

Excluding long-term funds such as major shareholders and industrial

capital, the actual free floated market value is around RMB 15 trillion.

If foreign capital flows in at a rate of one trillion yuan per year, it will

become the key marginal incremental capital on the market.

CCFA JOURNAL OF FINANCE AUGUST 2020 Page 34 第34页