Page 24 - Gross Income class slides

P. 24

GROSS INCOMEOSS INCOME

GR

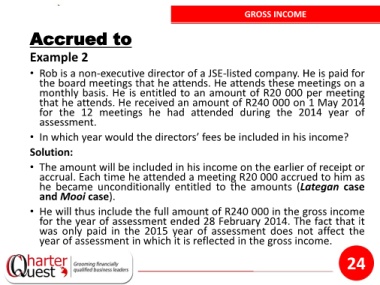

Accrued to

Example 2

• Rob is a non-executive director of a JSE-listed company. He is paid for

the board meetings that he attends. He attends these meetings on a

monthly basis. He is entitled to an amount of R20 000 per meeting

that he attends. He received an amount of R240 000 on 1 May 2014

for the 12 meetings he had attended during the 2014 year of

assessment.

• In which year would the directors’ fees be included in his income?

Solution:

• The amount will be included in his income on the earlier of receipt or

accrual. Each time he attended a meeting R20 000 accrued to him as

he became unconditionally entitled to the amounts (Lategan case

and Mooi case).

• He will thus include the full amount of R240 000 in the gross income

for the year of assessment ended 28 February 2014. The fact that it

was only paid in the 2015 year of assessment does not affect the

year of assessment in which it is reflected in the gross income.

24