Page 27 - Gross Income class slides

P. 27

GROSS INCOMEOSS INCOME

GR

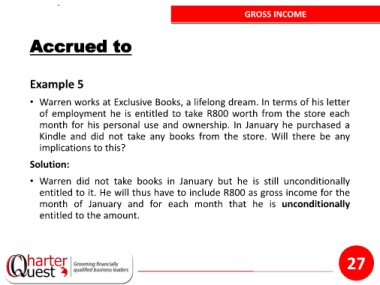

Accrued to

Example 5

• Warren works at Exclusive Books, a lifelong dream. In terms of his letter

of employment he is entitled to take R800 worth from the store each

month for his personal use and ownership. In January he purchased a

Kindle and did not take any books from the store. Will there be any

implications to this?

Solution:

• Warren did not take books in January but he is still unconditionally

entitled to it. He will thus have to include R800 as gross income for the

month of January and for each month that he is unconditionally

entitled to the amount.

27