Page 29 - Gross Income class slides

P. 29

GR

GROSS INCOMEOSS INCOME

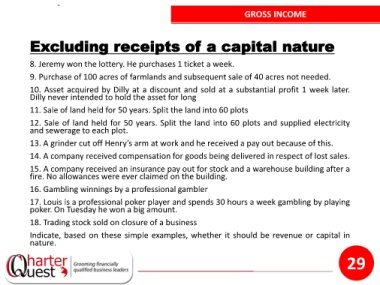

Excluding receipts of a capital nature

8. Jeremy won the lottery. He purchases 1 ticket a week.

9. Purchase of 100 acres of farmlands and subsequent sale of 40 acres not needed.

10. Asset acquired by Dilly at a discount and sold at a substantial profit 1 week later.

Dilly never intended to hold the asset for long

11. Sale of land held for 50 years. Split the land into 60 plots

12. Sale of land held for 50 years. Split the land into 60 plots and supplied electricity

and sewerage to each plot.

13. A grinder cut off Henry’s arm at work and he received a pay out because of this.

14. A company received compensation for goods being delivered in respect of lost sales.

15. A company received an insurance pay out for stock and a warehouse building after a

fire. No allowances were ever claimed on the building.

16. Gambling winnings by a professional gambler

17. Louis is a professional poker player and spends 30 hours a week gambling by playing

poker. On Tuesday he won a big amount.

18. Trading stock sold on closure of a business

Indicate, based on these simple examples, whether it should be revenue or capital in

nature.

29