Page 25 - Gross Income class slides

P. 25

GROSS INCOMEOSS INCOME

GR

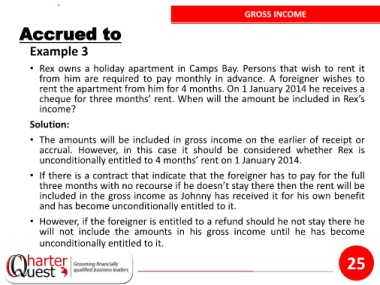

Accrued to

Example 3

• Rex owns a holiday apartment in Camps Bay. Persons that wish to rent it

from him are required to pay monthly in advance. A foreigner wishes to

rent the apartment from him for 4 months. On 1 January 2014 he receives a

cheque for three months’ rent. When will the amount be included in Rex’s

income?

Solution:

• The amounts will be included in gross income on the earlier of receipt or

accrual. However, in this case it should be considered whether Rex is

unconditionally entitled to 4 months’ rent on 1 January 2014.

• If there is a contract that indicate that the foreigner has to pay for the full

three months with no recourse if he doesn’t stay there then the rent will be

included in the gross income as Johnny has received it for his own benefit

and has become unconditionally entitled to it.

• However, if the foreigner is entitled to a refund should he not stay there he

will not include the amounts in his gross income until he has become

unconditionally entitled to it.

25