Page 28 - Gross Income class slides

P. 28

GROSS INCOMEOSS INCOME

GR

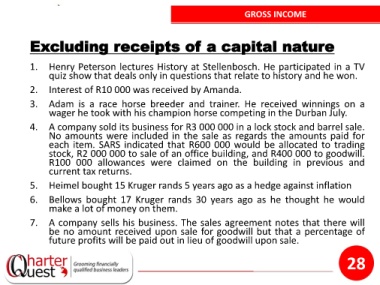

Excluding receipts of a capital nature

1. Henry Peterson lectures History at Stellenbosch. He participated in a TV

quiz show that deals only in questions that relate to history and he won.

2. Interest of R10 000 was received by Amanda.

3. Adam is a race horse breeder and trainer. He received winnings on a

wager he took with his champion horse competing in the Durban July.

4. A company sold its business for R3 000 000 in a lock stock and barrel sale.

No amounts were included in the sale as regards the amounts paid for

each item. SARS indicated that R600 000 would be allocated to trading

stock, R2 000 000 to sale of an office building, and R400 000 to goodwill.

R100 000 allowances were claimed on the building in previous and

current tax returns.

5. Heimel bought 15 Kruger rands 5 years ago as a hedge against inflation

6. Bellows bought 17 Kruger rands 30 years ago as he thought he would

make a lot of money on them.

7. A company sells his business. The sales agreement notes that there will

be no amount received upon sale for goodwill but that a percentage of

future profits will be paid out in lieu of goodwill upon sale.

28