Page 26 - Gross Income class slides

P. 26

GROSS INCOMEOSS INCOME

GR

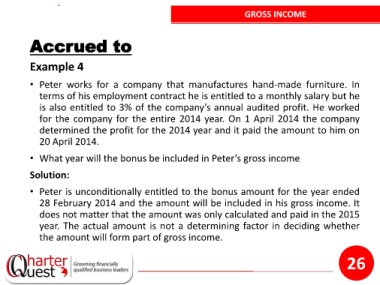

Accrued to

Example 4

• Peter works for a company that manufactures hand-made furniture. In

terms of his employment contract he is entitled to a monthly salary but he

is also entitled to 3% of the company’s annual audited profit. He worked

for the company for the entire 2014 year. On 1 April 2014 the company

determined the profit for the 2014 year and it paid the amount to him on

20 April 2014.

• What year will the bonus be included in Peter’s gross income

Solution:

• Peter is unconditionally entitled to the bonus amount for the year ended

28 February 2014 and the amount will be included in his gross income. It

does not matter that the amount was only calculated and paid in the 2015

year. The actual amount is not a determining factor in deciding whether

the amount will form part of gross income.

26