Page 29 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 29

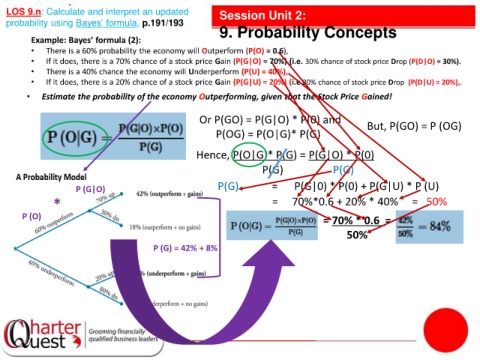

LOS 9.n: Calculate and interpret an updated Session Unit 2:

probability using Bayes’ formula, p.191/193

9. Probability Concepts

Example: Bayes’ formula (2):

• There is a 60% probability the economy will Outperform (P(O) = 0.6),

• If it does, there is a 70% chance of a stock price Gain (P(G|O) = 70%) (i.e. 30% chance of stock price Drop (P(D|O) = 30%).

• There is a 40% chance the economy will Underperform (P(U) = 40%),

• If it does, there is a 20% chance of a stock price Gain (P(G|U) = 20%) (i.e 80% chance of stock price Drop (P(D|U) = 20%),.

• Estimate the probability of the economy Outperforming, given that the Stock Price Gained!

Or P(GO) = P(G|O) * P(0) and But, P(GO) = P (OG)

P(OG) = P(O|G)* P(G)

Hence, P(O|G)* P(G) = P(G|O) * P(0)

P(G) P(G)

P (G|O) P(G) = P(G|0) * P(0) + P(G|U) * P (U)

* = 70%*0.6 + 20% * 40% = 50%

P (O)

= 70% * 0.6 =

50%

P (G) = 42% + 8%