Page 162 - Microsoft Word - 00 P1 IW Prelims.docx

P. 162

Chapter 12

Corporate failure prediction models

Quantitative and qualitative models exist.

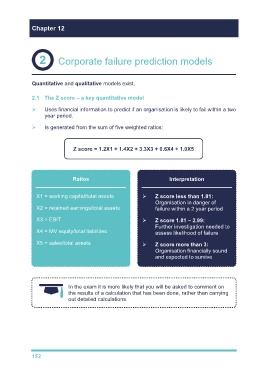

2.1 The Z score – a key quantitative model

Uses financial information to predict if an organisation is likely to fail within a two

year period.

Is generated from the sum of five weighted ratios:

Z score = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 1.0X5

Ratios Interpretation

X1 = working capital/total assets Z score less than 1.81:

Organisation in danger of

X2 = retained earnings/total assets failure within a 2 year period

X3 = EBIT Z score 1.81 – 2.99:

Further investigation needed to

X4 = MV equity/total liabilities assess likelihood of failure

X5 = sales/total assets Z score more than 3:

Organisation financially sound

and expected to survive

In the exam it is more likely that you will be asked to comment on

the results of a calculation that has been done, rather than carrying

out detailed calculations.

152