Page 21 - Cusmomer Guide

P. 21

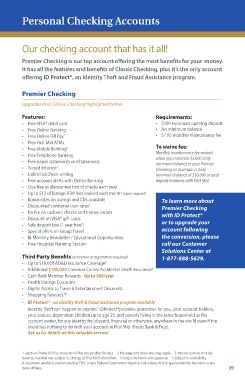

Personal Checking Accounts

Our checking account that has it all!

Premier Checking is our top account offering the most benefits for your money.

It has all the features and benefits of Classic Checking, plus it’s the only account

offering ID Protect®, an Identity Theft and Fraud Assistance program.

Premier Checking

Upgrades from Classic Checking highlighted below.

Features: Requirements:

• Free VISA® debit card • $100 minimum opening deposit

• Free Online Banking • No minimum balance

• Free Online Bill Pay 1 • $7.95 monthly maintenance fee

• Free First Mid ATMs To waive fee:

• Free Mobile Banking 2

• Free Telephone Banking Monthly maintenance fee waived

when you maintain $5,000 daily

• Free paper statements or eStatements minimum balance in your Premier

• Tiered interest 3 Checking, or maintain a daily

• Unlimited check writing minimum balance of $50,000 in total

• Free account alerts with Online Banking deposit balances with First Mid.

• One free or discounted box of checks each year

• Up to $12 of foreign ATM fees waived each month (upon request)

• Bonus rates on savings and CDs available To learn more about

• Discounted consumer loan rates 4 Premier Checking

• No fee on cashier’s checks and money orders with ID Protect®

• Discount on VISA® gift cards or to upgrade your

• Safe deposit box (1 year free) 5

• Special offers on Group Travel account following

• Bi-Monthly Newsletter / Educational Opportunities the conversion, please

• Free Financial Planning Session call our Customer

Solutions Center at

Third Party Benefits (activation or registration required) 1-877-888-5629.

• Up to $10,000 AD&D Insurance Coverage 6

• Additional $100,000 Common Carrier Accidental Death Insurance 6

• Cash Back Member Rewards - Up to $80/year

• Health Savings Discounts

• Digital Access to Travel & Entertainment Discounts

• $hopping Rewards TM

• ID Protect® - an identity theft & fraud assistance program available

Identity Theft can happen to anyone! IDProtect®provides protection for you, joint account holders,

your spouse, dependent children up to age 25, and parents living in the same household as the

account owner, for any identity fraud event, financial or otherwise, anywhere in the world even if the

event has nothing to do with your account at First Mid-Illinois Bank & Trust.

Ask us for details on this valuable service!

1 Inactive Online Bill Pay accounts will be closed after 90 days. 2 Message and data rates may apply. 3 Interest earned on daily

balance. Variable rate subject to change at First Mid’s discretion. 4 Subject to terms and approval. 5 Subject to availability.

6. Insurance product is not insured by FDIC or any Federal Government Agency; not a deposit of or guaranteed by the bank or any

bank affiliate. 19