Page 23 - Cusmomer Guide

P. 23

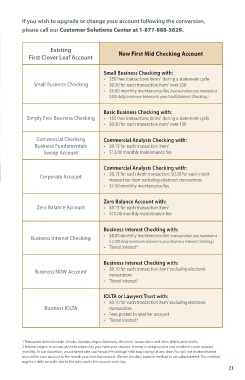

If you wish to upgrade or change your account following the conversion,

please call our Customer Solutions Center at 1-877-888-5629.

Existing

First Clover Leaf Account New First Mid Checking Account

Small Business Checking with:

• 250 free transactions items during a statement cycle

1

Small Business Checking • $0.30 for each transaction item over 250

1

• $5.00 monthly maintenance fee (waived when you maintain a

$300 daily minimum balance in your Small Business Checking.)

Basic Business Checking with:

Simply Free Business Checking • 150 free transactions items during a statement cycle

1

1

• $0.30 for each transaction item over 150

Commercial Checking Commercial Analysis Checking with:

Business Fundamentals • $0.15 for each transaction item 1

Sweep Account • $12.00 monthly maintenance fee

Commercial Analysis Checking with:

Corporate Account • $0.15 for each debit transaction; $0.10 for each credit

transaction item excluding electronic transactions

1

• $7.50 monthly maintenance fee

Zero Balance Account with:

Zero Balance Account • $0.15 for each transaction item 1

• $10.00 monthly maintenance fee

Business Interest Checking with:

Business Interest Checking • $8.00 monthly maintenance fee (waived when you maintain a

$1,500 daily minimum balance in your Business Interest Checking.)

• Tiered Interest 2

Business Interest Checking with:

1

Business NOW Account • $0.10 for each transaction item excluding electronic

transactions

• Tiered Interest 2

IOLTA or Lawyers Trust with:

1

• $0.10 for each transaction item excluding electronic

Business IOLTA transactions

• Fees posted to another account

• Tiered Interest 2

1 Transaction items include: checks, deposits, deposited items, electronic transactions and other debits and credits.

2 Interest begins to accrue on the business day you make your deposit. Interest is compounded and credited to your account

monthly. At our discretion, your interest rate and Annual Percentage Yield may change at any time. You will not receive interest

accrued on your account in the month you close the account. We use the daily balance method to calculate interest. This method

applies a daily periodic rate to the principal in the account each day.

21