Page 180 - AR DPBM-2016--SMALL

P. 180

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

Kemampuan Membayar Manfaat dan Kolektibilitas Piutang

Ability To Pay The Benefits and Receivables Collectibility

KEMAMPUAN MEMBAYAR MANFAAT PENSIUN ABILITy TO PAy THE PENSION BENEFITS

Kemampuan DPBM dalam melakukan pembayaran Manfaat The ability of DPBM in making the Pension Benefit payments

Pensiun dapat dilihat dari kemampuan Likuiditasnya. Dalam can be seen from its liquidity capability. In the latest Investment

Arahan Investasi dari Pendiri terbaru tanggal 31 Mei 2016, Directive from the Founder dated May 31, 2016, the liquidity

kebutuhan Likuiditas yang ditetapkan adalah sebagai berikut: requirements set forth were as follows:

• Pengurus dalam mengoptimalkan hasil investasi harus • The Managing Board should optimize investment returns

menjaga kebutuhan likuiditas DPBM dalam jangka waktu by maintaining the DPBM liquidity requirements for 1

1 (satu) bulan, yang terdiri dari Kas Kecil, Rekening Giro, (one) month, consisting of Petty Cash, Demand Deposit

Tabungan, Deposito On Call, dan/atau Deposito Berjangka Accounts, Savings, On Call Deposits, and/or Time Deposits

waktu 1 (satu) bulan. of 1 (one) month.

• Kebutuhan Likuiditas ditetapkan sekurang-kurangnya • Liquidity requirements should be set at least to match the

sebesar kewajiban pembayaran Manfaat Pensiun dan pension benefit obligations and DPBM operational needs

kebutuhan operasional DPBM di setiap bulannya. each month.

Likuiditas minimum portofolio investasi DPBM per 31 DPBM’s minimum liquidity for the investment portfolio as

Desember 2016 telah memenuhi ketentuan yang ditetapkan of December 31, 2016 has complied with the provisions

dalam Arahan Investasi, yaitu tidak kurang dari jangka waktu stipulated in the Investment Directive, which was for at least

1 (satu) bulan sesuai dengan kewajiban pembayaran Manfaat 1 (one) month in accordance with the obligations for Pension

Pensiun dan kebutuhan operasional DPBM. Benefits and DPBM operational requirements.

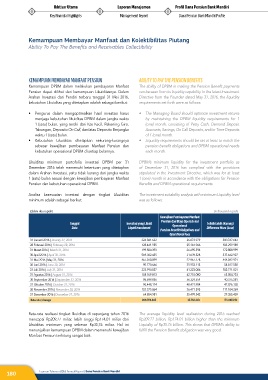

Analisa kesesuaian investasi dengan tingkat Likuiditas The investment suitability analysis with minimum Liquidity level

minimum adalah sebagai berikut: was as follows:

(dalam ribu rupiah) (in thousand rupiah)

Kewajiban Pembayaran Manfaat

Pensiun dan Biaya Operasional

Tanggal Investasi yang Likuid Operasional Selisih Lebih (Kurang)

Date Liquid Investment Difference More (Less)

Pension Benefit Obligations and

Operational Fees

31 Januari 2016 | January 31, 2016 326.841.622 26.073.979 300.767.643

28 Februari 2016 | February 28, 2016 128.461.955 25.161.966 103.299.989

31 Maret 2016 | March 31, 2016 199.504.393 26.695.394 172.808.999

30 April 2016 | April 30, 2016 569.302.455 31.639.528 537.662.927

31 Mei 2016 | May 31, 2016 467.010.099 22.967.178 444.042.921

30 Juni 2016 | June 30, 2016 90.770.666 35.953.115 54.817.550

31 Juli 2016 | July 31, 2016 223.994.027 41.223.006 182.771.021

31 Agustus 2016 | August 31, 2016 105.769.813 42.715.080 63.054.733

30 September 2016 | September 31, 2016 96.699.836 56.324.554 40.375.281

31 Oktober 2016 | October 31, 2016 90.448.114 48.421.984 42.026.130

30 November 2016 | November 30, 2016 153.575.864 36.471.595 117.104.269

31 Desember 2016 | December 31, 2016 64.854.981 35.499.542 29.355.439

Rata-rata | Average 209.769.485 35.762.243 174.007.242

Rata-rata realisasi tingkat likuiditas di sepanjang tahun 2016 The average liquidity level realization during 2016 reached

mencapai Rp209,77 miliar, lebih tinggi Rp174,01 miliar dari Rp209.77 billion, Rp174.01 billion higher than the minimum

Likuiditas minimum yang sebesar Rp35,76 miliar. Hal ini Liquidity of Rp35.76 billion. This shows that DPBM’s ability to

menunjukkan kemampuan DPBM dalam memenuhi kewajiban fulfill the Pension Benefit obligation was very good.

Manfaat Pensiun terhitung sangat baik.

180 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri